What Makes a Safe Asset Safe?

Over the last decade, the concept of “safe assets” has received increasing attention, from regulators and private market participants, as well as researchers. This attention has led to the uncovering of some important details and nuances of what makes an asset “safe” and why it matters. In this blog post, we provide a review of the different aspects of safe assets, discuss possible reasons why they may be beneficial for investors, and give concrete examples of what these assets are in practice.

The Treasury Market Practices Group: A Consequential First Decade

A Closer Look at the Fed’s Balance Sheet Accounting

An earlier post on how the Fed changes the size of its balance sheet prompted several questions from readers about the Federal Reserve’s accounting of asset purchases and the payment of principal by the Treasury on Treasury securities owned by the Fed. In this post, we provide a more detailed explanation of the accounting rules that govern these transactions.

How the Fed Changes the Size of Its Balance Sheet

The size of the Federal Reserve’s balance sheet increased greatly between 2009 and 2014 owing to large-scale asset purchases. The balance sheet has stayed at a high level since then through the ongoing reinvestment of principal repayments on securities that the Fed holds. When the Federal Open Market Committee (FOMC) decides to reduce the size of the Fed’s balance sheet, it is expected to do so by gradually reducing the pace of reinvestments, as outlined in the June 2017 addendum to the FOMC’s Policy Normalization Principles and Plans. How do asset purchases increase the size of the Fed’s balance sheet? And how would reducing reinvestments reduce the size of the balance sheet? In this post, we answer these questions by describing the mechanics of the Fed’s balance sheet. In our next post, we will describe the balance sheet mechanics with respect to agency mortgage-backed securities (MBS).

Beyond 30: Long‑Term Treasury Bond Issuance from 1957 to 1965

As noted in our previous post, thirty years has marked the outer boundary of Treasury bond maturities since “regular and predictable” issuance of coupon-bearing Treasury debt became the norm in the 1970s. However, the Treasury issued bonds with maturities of greater than thirty years on seven occasions in the 1950s and 1960s, in an effort to lengthen the maturity structure of the debt. While our earlier post described the efforts of Treasury debt managers to lengthen debt maturities between 1953 and 1957, this post examines the period from 1957 to 1965.

Beyond 30: Long‑Term Treasury Bond Issuance from 1953 to 1957

Ever since “regular and predictable” issuance of coupon-bearing Treasury debt became the norm in the 1970s, thirty years has marked the outer boundary of Treasury bond maturities. However, longer-term bonds were not unknown in earlier years. Seven such bonds, including one 40-year bond, were issued between 1955 and 1963. The common thread that binds the seven bonds together was the interest of Treasury debt managers in lengthening the maturity structure of the debt. This post describes the efforts to lengthen debt maturities between 1953 and 1957. A subsequent post will examine the period from 1957 to 1965.

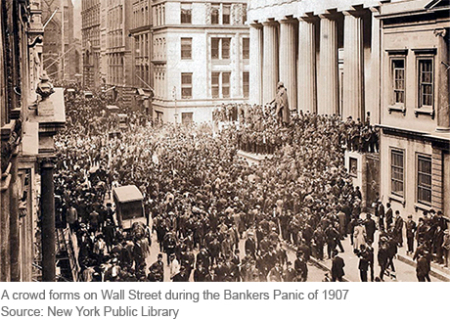

The Final Crisis Chronicle: The Panic of 1907 and the Birth of the Fed

The panic of 1907 was among the most severe we’ve covered in our series and also the most transformative, as it led to the creation of the Federal Reserve System. Also known as the “Knickerbocker Crisis,” the panic of 1907 shares features with the 2007-08 crisis, including “shadow banks” in the form high-flying, less-regulated trusts operating beyond the safety net of the time, and a pivotal “Lehman moment” when Knickerbocker Trust, the second-largest trust in the country, was allowed to fail after J.P. Morgan refused to save it.

Why Did the Recent Oil Price Declines Affect Bond Prices of Non‑Energy Companies?

Oil prices plunged 65 percent between July 2014 and December of the following year. During this period, the yield spread—the yield of a corporate bond minus the yield of a Treasury bond of the same maturity—of energy companies shot up, indicating increased credit risk. Surprisingly, the yield spread of non‑energy firms also rose even though many non‑energy firms might be expected to benefit from lower energy‑related costs. In this blog post, we examine this counterintuitive result. We find evidence of a liquidity spillover, whereby the bonds of more liquid non‑energy firms had to be sold to satisfy investors who withdrew from bond funds in response to falling energy prices.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics