Puerto Rico recently observed the one-year anniversary of Hurricane Maria—the most destructive storm to hit the Commonwealth since the San Felipe Segundo hurricane in 1928. Maria, combined with Hurricane Irma, which had glanced the island about two weeks prior, is estimated to have caused nearly 3,000 deaths and tens of billions of dollars of physical damage. Millions went without power for weeks, in most cases months. Basic services—water, sewage, telecommunications, medical care, schools—suffered massive disruptions. While it is difficult to assign a cost to all the suffering endured by Puerto Rico’s population, we can now at least get a better read on the economic effect of the storms. In this blog post, we look at a few key economic indicators to gauge the negative effects of the storms and the extent of the subsequent rebound—not only for the Commonwealth as a whole, but for its various geographic areas and industry sectors. We also examine data from the New York Fed Consumer Credit Panel to assess how well households held up financially and what effects the home mortgage foreclosure and payment moratoria had.

Overall Economy

When last year’s hurricanes struck, Puerto Rico’s economy had already been struggling with a decade-long slump and a fiscal crisis. Initially, the hurricanes exacerbated a complex pre-existing problem: a population, economy, and tax base that were all in decline. In the fourth quarter of 2017, following Maria, we estimate that roughly 200,000 residents left the island for the mainland. According to the Puerto Rico Institute of Statistics, 72,000 had returned by April 2018, and we estimate that as of June, about 100,000 had returned, leaving the net decline at 100,000—still a 3 percent drop in the population, which had already fallen by about 12 percent (500,000) since peaking in 2005.

Over the years, Puerto Rico’s population loss has contributed to a feedback loop: a lack of economic opportunity and jobs spurs outmigration, which further undermines the island’s economic prospects. Even before the storm, private-sector employment had contracted by about 12 percent since 2005. In the month after Maria, it tumbled another 7 percent, according to early benchmark data (employment estimates that are updated quarterly to use the most complete information available). But it has since recovered significantly: as of August 2018, private-sector employment had rebounded by 5 percent from the post-storm trough and was down 2 percent from its pre-storm levels—still a sizable drop, but considerably less than the decline seen after some similar disasters.

But what about overall wage and salary income, which is an even more telling measure of economic vitality than employment—has that bounced back as well? As it turns out, wage and salary income took a much bigger hit than employment during and right after the storm. But, for reasons addressed in the next section, income has since rebounded more substantially, reaching new highs in early 2018. While the number of job-holders was down about 3 percent in early 2018 versus early 2017 (that is, before the storm), average wage and salary income for these job-holders was up about 7 percent—more than 5 percentage points above the 1.6 percent rise in the CPI.

Industry Crosscurrents

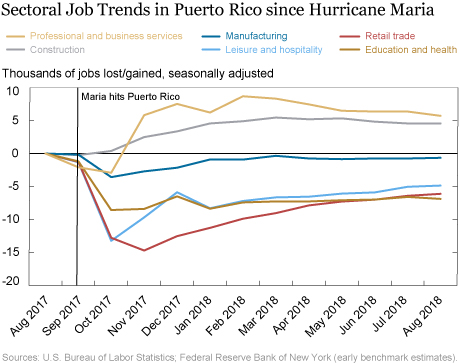

While overall employment has reversed much of its steep initial post-hurricane drop, some regions and industry sectors have fared much worse than others. In terms of industries, the post-Maria trends have largely, but not entirely, followed typical patterns after major natural disasters. The leisure and hospitality industry was one of the hardest hit and has been one of the slowest to recover—especially the accommodation segment, where employment plunged more than 20 percent—consistent with a sharp drop in tourism. Retail trade employment has also been hit very hard. Less typically, there have been sizable and sustained job losses in education and health services.

At the other end of the spectrum are two sectors that have seen sizable job gains since the storm. Not surprisingly, construction employment has surged nearly 25 percent since Maria, as restoration and rebuilding have moved into high gear. Another sector that appears to have fared well is professional and business services, where there has been sturdy job creation since the hurricanes—particularly in waste management and remediation.

If employment has not fully rebounded, why has wage and salary income climbed above pre-hurricane levels? The main contributing factor has been within the construction industry, where average pay per worker soared more than 50 percent in the first quarter from a year earlier! Even though construction represents only about 4 percent of private-sector employment, that surge is big enough to bring up the average quite a bit. But what about salaries accruing to the other 96 percent of jobs? Well, although the gain is not nearly as large, average pay outside the construction sector was still up moderately in early 2018.

So, are workers really better off in 2018 than they were before the storm? Not necessarily. Construction workers certainly seem to be doing better, though the data may exaggerate how much better, since at least some of these higher-paying construction jobs may be going to relief and rescue workers from the mainland, as opposed to local residents. Even aside from construction, the rise in average pay largely reflects a shift in the industry mix: fewer jobs in lower-wage sectors like restaurants and retailers, and more jobs in higher-paying industries like professional and business services. Thus, there would appear to be fewer job opportunities for many of the more vulnerable low- to moderate-income Puerto Ricans.

The Recovery Leaves Some Areas Behind

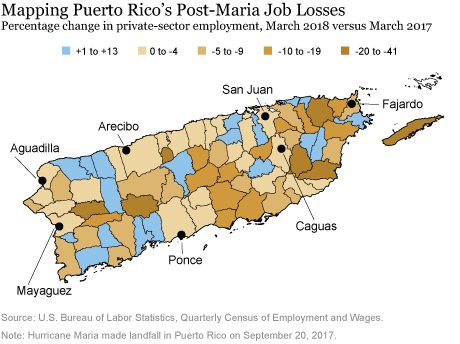

Puerto Rico’s economy is geographically diverse, and the more rural mountainous regions in the interior of the island tend to be far less affluent than the major coastal cities, most notably San Juan. And these interior areas were among the hardest to reach in the weeks and months after the storm. Destruction was also particularly widespread throughout the southeastern quadrant, where Maria made landfall and was most powerful. These tended to be among the last areas to have electricity restored.

Local employment data, now available through March 2018, paint a very mixed picture of the recovery. San Juan had recouped almost all of its post-hurricane job losses by March 2018, while adjacent municipios were not far behind. Results for other cities were mixed—Ponce, Caguas, and Mayaguez had all sustained steep job losses right after Maria. Ponce’s job count had rebounded almost fully by March, whereas Mayaguez saw a sub-par recovery. Caguas experienced a fairly average rebound, as did Arecibo and Aguadilla. But, as of March, employment was still down roughly 40 percent from a year earlier in Vieques and down more than 20 percent in many of the interior areas (see map below). It remains to be seen whether many of these hard-hit, more remote municipios see significant population loss as well.

Mortgage Payment and Foreclosure Moratoria in Puerto Rico

One major concern in the storms’ aftermath was that many homeowners would fall behind on their mortgages and possibly face foreclosure, with some experts predicting a large wave of post-storm delinquency and foreclosures. However, a number of temporary policies were implemented to provide troubled homeowners time to recover: forbearance on mortgage payments—along with a suspension of late fees and credit reporting, and a potential loan modification to avoid a big jump in payments when the forbearance ends—and a moratorium on new foreclosures. Although press reports from early 2018 described considerable confusion and frustration among Puerto Rican mortgage-holders about the details of these policies—deadlines, application procedures, eligibility requirements, and so on—they had a noticeable impact, and some were extended as far out as August 2018.

To highlight this impact, we turn to the New York Fed Consumer Credit Panel (CCP), a data set constructed from Equifax credit report data that offers insight into mortgage balances and payment behavior, both on the mainland and in Puerto Rico. Because the moratoria prevented the reporting of delinquencies for participating mortgages on credit reports, mortgage delinquency has been muted in Puerto Rico, dropping substantially before returning roughly to the pre-storm trend. The foreclosure moratorium had the intended effect of stopping foreclosure starts: new foreclosures on credit reports went to nearly zero in the quarters after the storm, before a small uptick in the second quarter of 2018.

We estimate, using CCP data, that the total value of payments skipped during the three quarters following the storm was at least $335 million, which we interpret as a short-term loan to mortgage-holders. Guidance on how these skipped payments will be handled has varied by lender and loan type, but a mortgage modification or a smaller second loan to be paid over the term of the mortgage are likely treatments.

Thus, these moratoria appear to have had their intended effects, although we await third-quarter data to see how the situation unfolds as the moratoria are lifted.

Looking Ahead

While employment and income appear to have rebounded from the post-Maria slump, and the Commonwealth appears to have averted a surge in foreclosures and delinquencies, that does not mean that Puerto Rico’s economy is out of the woods. First, the fiscal, economic, and infrastructure problems that were so prevalent before the hurricanes still loom. Second, much of the recent rebound in economic activity is being driven by federal aid, insurance payouts, and massive reconstruction activity—stimulus that is likely to continue for a while, but not indefinitely. Still, some credit for the economic rebound must go to the people of Puerto Rico, who have shown tremendous fortitude during this incredibly difficult year. We will continue to monitor developments across the various sectors on the island in the coming months; stay tuned to this blog for a more detailed picture of Puerto Rico’s household debt situation.

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

Jason Bram is a research officer in the Federal Reserve Bank of New York’s Research and Statistics Group.

Jason Bram is a research officer in the Federal Reserve Bank of New York’s Research and Statistics Group.

Joelle Scally is a senior data strategist in the Bank’s Research and Statistics Group.

How to cite this blog post:

Jason Bram and Joelle Scally, “Puerto Rico Post-Maria: Twelve Months of Hardship,” Federal Reserve Bank of New York Liberty Street Economics (blog), September 28, 2018, http://libertystreeteconomics.newyorkfed.org/2018/09/puerto-rico-post-maria-twelve-months-of-hardship.html.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics