How the LIBOR Transition Affects the Supply of Revolving Credit

In the United States, most commercial and industrial (C&I) lending takes the form of revolving lines of credit, known as revolvers or credit lines. For decades, like other U.S. C&I loans, credit lines were typically indexed to the London Interbank Offered Rate (LIBOR). However, since 2022, the U.S. and other developed-market economies have transitioned from credit-sensitive reference rates such as LIBOR to new risk-free rates, including the Secured Overnight Financing Rate (SOFR). This post, based on a recent New York Fed Staff Report, explores how the provision of revolving credit is likely to change as a result of the transition to a new reference rate.

Does Bank Monitoring Affect Loan Repayment?

Banks monitor borrowers after originating loans to reduce moral hazard and prevent loan losses. While monitoring represents an important activity of bank business, evidence on its effect on loan repayment is scant. In this post, which is based on our recent paper, we shed light on whether bank monitoring fosters loan repayment and to what extent it does so.

Balances Are on the Rise—So Who Is Taking on More Credit Card Debt?

Total household debt balances continued their upward climb in the third quarter of 2022 with an increase of $351 billion, the largest nominal quarterly increase since 2007. This rise was driven by a $282 billion increase in mortgage balances, according to the latest Quarterly Report on Household Debt & Credit from the New York Fed’s Center for Microeconomic Data. Mortgages, historically the largest form of household debt, now comprise 71 percent of outstanding household debt balances, up from 69 percent in the fourth quarter of 2019. An increase in credit card balances was also a boost to the total debt balances, with credit card balances up $38 billion from the previous quarter. On a year-over-year basis, this marked a 15 percent increase, the largest in more than twenty years. Here, we take a closer look at the variation in credit card trends for different demographics of borrowers using our Consumer Credit Panel (CCP), which is based on credit reports from Equifax.

Is China Running Out of Policy Space to Navigate Future Economic Challenges?

After making progress slowing the pace of debt accumulation prior to the pandemic, China saw its debt levels surge in 2020 as the government responded to the severe economic slowdown with credit-led stimulus. With China currently in the midst of another sharp decline in economic activity due to its property slump and zero-COVID strategy, Chinese authorities have responded again by pushing out credit to soften the downturn despite already high levels of debt on corporate, household, and government balance sheets. In this post, we revisit China’s debt buildup and consider the growing constraints on Chinese policymakers’ tools to navigate future economic challenges.

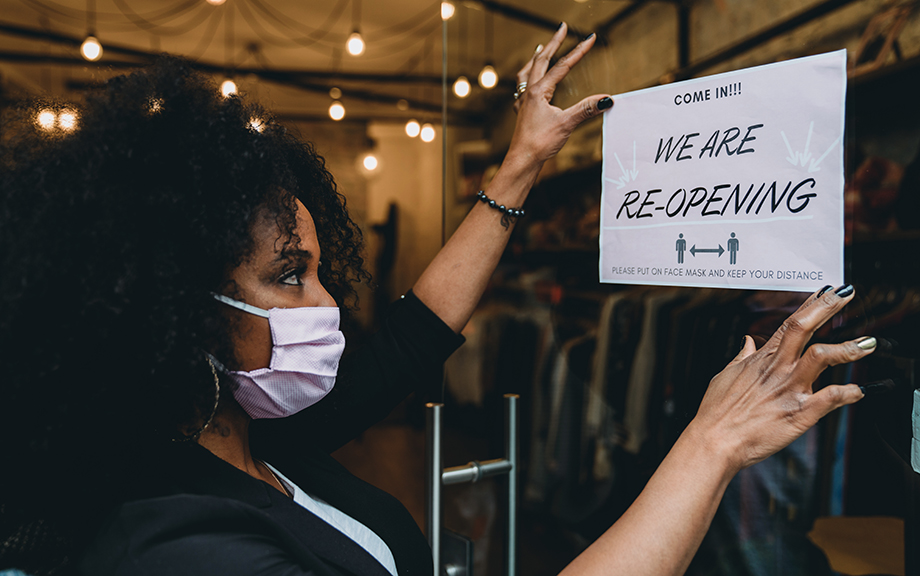

Small Business Recovery after Natural Disasters

The first post of this series found that small businesses owned by people of color are particularly vulnerable to natural disasters. In this post, we focus on the aftermath of disasters, and examine disparities in the ability of firms to reopen their businesses and access disaster relief. Our results indicate that Black-owned firms are more likely to remain closed for longer periods and face greater difficulties in obtaining the immediate relief needed to cope with a natural disaster.

How Do Natural Disasters Affect U.S. Small Business Owners?

Recent research has linked climate change and socioeconomic inequality (see here, here, and here). But what are the effects of climate change on small businesses, particularly those owned by people of color, which tend to be more resource-constrained and less resilient? In a series of two posts, we use the Federal Reserve’s Small Business Credit Survey (SBCS) to document small businesses’ experiences with natural disasters and how these experiences differ based on the race and ethnicity of business owners. This first post shows that small firms owned by people of color sustain losses from natural disasters at a disproportionately higher rate than other small businesses, and that these losses make up a larger portion of their total revenues. In the second post, we explore the ability of small firms to reopen and to obtain disaster relief funding in the aftermath of climate events.

Consumer Scores and Price Discrimination

Most American consumers likely are familiar with credit scores, as every lender in the United States uses them to evaluate credit risk. But the Customer Lifetime Value (CLV) that many firms use to target ads, prices, products, and service levels to individual consumers may be less familiar, or the Affluence Index that ranks households according to their spending power. These are just a few among a plethora of scores that have emerged recently, consequence of the abundant consumer data that can be gathered online. Such consumer scores use data on age, ethnicity, gender, household income, zip code, and purchases as inputs to create numbers that proxy for consumer characteristics or behaviors that are of interest to firms. Unlike traditional credit scores, however, these scores are not available to consumers. Can a consumer benefit from data collection even if the ensuing scores are eventually used “against” her, for instance, by enabling firms to set individualized prices? Would it help her to know her score? And how would firms try to counteract the consumer’s response?

Did Changes to the Paycheck Protection Program Improve Access for Underserved Firms?

Prior research has shown that many small and minority-owned businesses failed to receive Paycheck Protection Program (PPP) loans in 2020. To increase program uptake to underserved firms, several changes were made to the PPP in 2021. Using data from the Federal Reserve Banks’ 2021 Small Business Credit Survey, we argue that these changes were effective in improving program access for nonemployer firms (that is, businesses with no employees other than the owner(s)). The changes may also have encouraged more applications from minority-owned firms, but they do not appear to have reduced disparities in approval rates between white- and minority-owned firms.

What Is Corporate Bond Market Distress?

Corporate bonds are a key source of funding for U.S. non-financial corporations and a key investment security for insurance companies, pension funds, and mutual funds. Distress in the corporate bond market can thus both impair access to credit for corporate borrowers and reduce investment opportunities for key financial sub-sectors. In a February 2021 Liberty Street Economics post, we introduced a unified measure of corporate bond market distress, the Corporate Bond Market Distress Index (CMDI), then followed up in early June 2022 with a look at how corporate bond market functioning evolved over 2022 in the wake of the Russian invasion of Ukraine and the tightening of U.S. monetary policy. Today we are launching the CMDI as a regularly produced data series, with new readings to be published each month. In this post, we describe what constitutes corporate bond market distress, motivate the construction of the CMDI, and argue that secondary market measures alone are insufficient to capture market functioning.

The First Global Credit Crisis

June 2022 marks the 250th anniversary of the outbreak of the 1772-3 credit crisis. Although not widely known today, this was arguably the first “modern” global financial crisis in terms of the role that private-sector credit and financial products played in it, in the paths of financial contagion that propagated the initial shock, and in the way authorities intervened to stabilize markets. In this post, we describe these developments and note the parallels with modern financial crises.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics