Moving Out of a Flood Zone? That May Be Risky!

An often-overlooked aspect of flood-plain mapping is the fact that these maps designate stark boundaries, with households falling either inside or outside of areas designated as “flood zones.” Households inside flood zones must insure themselves against the possibility of disasters. However, costly insurance may have pushed lower-income households out of areas officially designated a flood risk and into physically adjacent areas. While not designated an official flood risk, Federal Emergency Management Agency (FEMA) and disaster data shows that these areas are still at considerable risk of flooding. In this post, we examine whether flood maps may have inadvertently clustered those households financially less able to bear the consequences of a disaster into areas that may still pose a significant flood risk.

CRISK: Measuring the Climate Risk Exposure of the Financial System

A growing number of climate-related policies have been adopted globally in the past thirty years (see chart below). The risk to economic activity from changes in policies in response to climate risks, such as carbon taxes and green subsidies, is often referred to as transition risk. Transition risk can adversely affect the real economy through […]

Monitoring Banks’ Exposure to Nonbanks: The Network of Interconnections Matters

The first post in this series discussed the potential exposure of banks to the open-end funds sector, by virtue of commonalities in asset holdings that expose banks to balance sheet losses in the event of an asset fire sale by these funds. In this post, we summarize the findings reported in a recent paper of ours, in which we expand the analysis to consider a broad cross section of non-bank financial institution (NBFI) segments. We unveil an innovative monitoring insight: the network of interconnections across NBFI segments and banks matters. For example, certain nonbank institutions may not have a meaningful asset overlap with banks, but their fire sales could nevertheless represent a vulnerability for banks because their assets overlap closely with other NBFIs that banks are substantially exposed to.

Enhancing Monitoring of NBFI Exposure: The Case of Open‑End Funds

Non-bank financial institutions (NBFIs) have grown steadily over the last two decades, becoming important providers of financial intermediation services. As NBFIs naturally interact with banking institutions in many markets and provide a wide range of services, banks may develop significant direct exposures stemming from these counterparty relationships. However, banks may be also exposed to NBFIs indirectly, simply by virtue of commonality in asset holdings. This post and its companion piece focus on this indirect form of exposure and propose ways to identify and quantify such vulnerabilities.

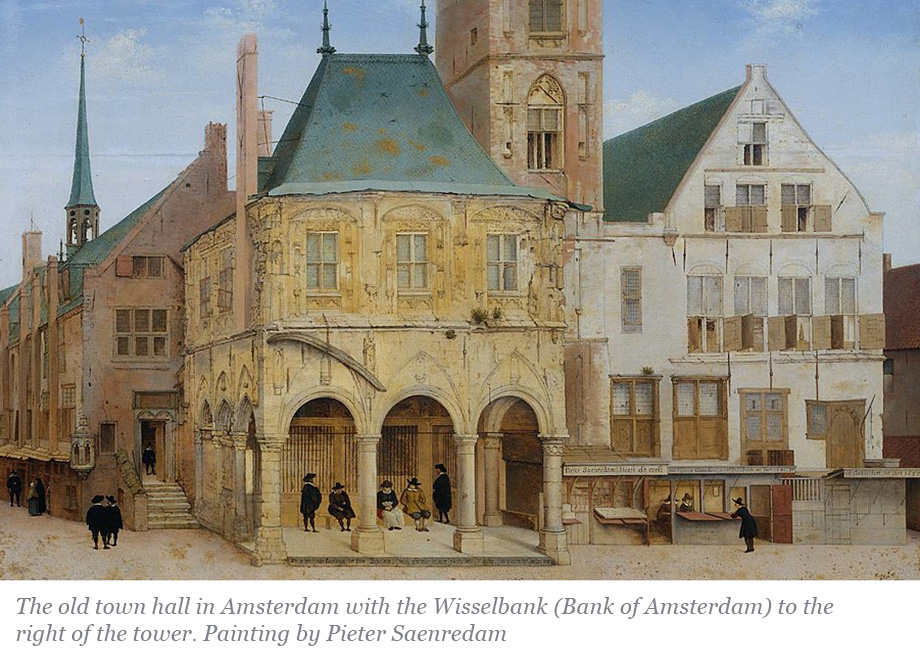

Financial Fragility without Banks

Proponents of narrow banking have argued that lender of last resort policies by central banks, along with deposit insurance and other government interventions in the money markets, are the primary causes of financial instability. However, as we show in this post, non-bank financial institutions (NBFIs) triggered a financial crisis in 1772 even though the financial system at that time had few banks and deposits were not insured. NBFIs profited from funding risky, longer-dated assets using cheap short-term wholesale funding and, when they eventually failed, authorities felt compelled to rescue the financial system.

Mitigating the Risk of Runs on Uninsured Deposits: the Minimum Balance at Risk

The incentives that drive bank runs have been well understood since the seminal work of Nobel laureates Douglas Diamond and Philip Dybvig (1983). When a bank is suspected to be insolvent, early withdrawers can get the full value of their deposits. If and when the bank runs out of funds, however, the bank cannot pay remaining depositors. As a result, all depositors have an incentive to run. The failures of Silicon Valley Bank and Signature Bank remind us that these incentives are still present for uninsured depositors, that is, those whose bank deposits are larger than deposit insurance limits. In this post, we discuss a policy proposal to reduce uninsured depositors’ incentives to run.

How Did New York City’s Economy Weather the Pandemic?

When COVID-19 first struck the U.S. in early 2020, New York City was the epicenter of the pandemic. By early April, there was an unthinkable scale of suffering, with massive hospitalizations and roughly 800 fatalities per day, accounting for nearly half of the nationwide total. The rapid spread was facilitated by the city’s extraordinarily high population density and widespread use of mass transit. What followed was a quick and massive shutdown of restaurants, retail stores, personal services, offices, and more. And the shutdowns, of course, led to widespread job losses. Between February and May, one out of five jobs in the city vanished; in the restaurant industry, 70 percent of jobs were lost. Although the pandemic didn’t go away, the city’s economy has recovered steadily, aside from a brief but sharp setback in late 2020. By early 2023, New York had finally reversed just about all of the total job loss. In this post, we look at the contours of the city’s recovery as a possible guide to where we go from here.

The Tri‑State Region’s Recovery from the Pandemic Recession Three Years On

The tri-state region’s economy was hit especially hard by the pandemic, but three years on, is close to recovering the jobs that were lost. Indeed, employment initially fell by 20 percent in New York City as the pandemic took hold, a significantly sharper decline than for the nation as a whole, and the rest of the region experienced similar declines, creating a much larger hole than in other parts of the country. Three years later, the recovery has been uneven: Recent job growth has been particularly strong in New York City, where employment remains just slightly below pre-pandemic levels, and in Northern New Jersey, which has more than recovered all of the jobs lost early in the pandemic. But it has been sluggish in downstate New York outside of New York City, and in upstate New York, and employment across the region has clearly not reached the level implied by pre-pandemic trends. A dearth of available workers remains a significant constraint on growth in the region, particularly in upstate New York, which had already been suffering from a lack of workers well before the pandemic began

Does Corporate Hedging of Foreign Exchange Risk Affect Real Economic Activity?

Foreign exchange derivatives (FXD) are a key tool for firms to hedge FX risk and are particularly important for exporting or importing firms in emerging markets. This is because FX volatility can be quite high—up to 120 percent per annum for some emerging market currencies during stress episodes—yet the vast majority of international trades, almost 90 percent, are invoiced in U.S. dollars (USD) or euros (EUR). When such hedging instruments are in short supply, what happens to firms’ real economic activities? In this post, based on my related Staff Report, I use hand-collected FXD contract-level data and exploit a quasi-natural experiment in South Korea to measure the real effects of hedging using FXD.

Deposit Betas: Up, Up, and Away?

Deposits make up an $18 trillion market that is simultaneously the main source of bank funding and a critical tool for households’ financial management. In a prior post, we explored how deposit pricing was changing slowly in response to higher interest rates as of 2022:Q2, as measured by a “deposit beta” capturing the pass-through of the federal funds rate to deposit rates. In this post, we extend our analysis through 2022:Q4 and observe a continued rise in deposit betas to levels not seen since prior to the global financial crisis. In addition, we explore variation across deposit categories to better understand banks’ funding strategies as well as depositors’ investment opportunities. We show that while regular deposit funding declines, banks substitute towards more rate-sensitive forms of finance such as time deposits and other forms of borrowing such as funding from Federal Home Loan Banks (FHLBs).

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics