Physical Climate Risk and Insurers

As the frequency and severity of natural disasters increase with climate change, insurance—the main tool for households and businesses to hedge natural disaster risks—becomes increasingly important. Can the insurance sector withstand the stress of climate change? To answer this question, it is necessary to first understand insurers’ exposure to physical climate risk, that is, risks coming from physical manifestations of climate change, such as natural disasters. In this post, based on our recent staff report, we construct a novel factor to measure the aggregate physical climate risk in the financial market and discuss its applications, including the assessment of insurers’ exposure to climate risk and the expected capital shortfall of insurers under climate stress scenarios.

What’s New with Corporate Leverage?

The Federal Open Market Committee (FOMC) started increasing rates on March 16, 2022, and after the January 31–February 1, 2023, FOMC meeting, the lower bound of the target range of the federal funds rate had reached 4.50 percent, a level last registered in November 2007. Such a rapid rates increase could pass through to higher funding costs for U.S. corporations. In this post, we examine how corporate leverage and bond market debt have evolved over the course of the current tightening cycle and compare the current experience to that during the previous three tightening cycles.

Is Your Apartment Breaking because Your Landlord Is Broke?

Thirty-one percent of housing units in the United States are rental units, and rental housing is unique because unlike in the case of homeownership, renters rely on the property owner for maintenance spending. From the property owner’s perspective, building maintenance is an important investment necessary to keep the asset in good condition. However, like all investments, it is only possible to maintain a building with sufficient financial resources. In a recent staff report, I examine the relationship between a building’s financing constraints and its maintenance. I find that financially constrained buildings, colloquially “broke,” tend to be less well maintained.

Do Corporate Profits Increase When Inflation Increases?

When inflation is high, companies may raise prices to keep up. However, market watchers and journalists have wondered if corporations have taken advantage of high inflation to increase corporate profits. We look at this question through the lens of public companies, finding that in general, increased prices in an industry are often associated with increasing corporate profits. However the current relationship between inflation and profit growth is not unusual in the historical context.

What Is Corporate Bond Market Distress?

Corporate bonds are a key source of funding for U.S. non-financial corporations and a key investment security for insurance companies, pension funds, and mutual funds. Distress in the corporate bond market can thus both impair access to credit for corporate borrowers and reduce investment opportunities for key financial sub-sectors. In a February 2021 Liberty Street Economics post, we introduced a unified measure of corporate bond market distress, the Corporate Bond Market Distress Index (CMDI), then followed up in early June 2022 with a look at how corporate bond market functioning evolved over 2022 in the wake of the Russian invasion of Ukraine and the tightening of U.S. monetary policy. Today we are launching the CMDI as a regularly produced data series, with new readings to be published each month. In this post, we describe what constitutes corporate bond market distress, motivate the construction of the CMDI, and argue that secondary market measures alone are insufficient to capture market functioning.

How Is the Corporate Bond Market Responding to Financial Market Volatility?

The Russian invasion of Ukraine increased uncertainty around the world. Although most U.S. companies have limited direct exposure to Ukrainian and Russian trading partners, increased global uncertainty may still have an indirect effect on funding conditions through tightening financial conditions. In this post, we examine how conditions in the U.S. corporate bond market have evolved since the start of the year through the lens of the U.S. Corporate Bond Market Distress Index (CMDI). As described in a previous Liberty Street Economics post, the index quantifies joint dislocations in the primary and secondary corporate bond markets and can thus serve as an early warning signal to detect financial market dysfunction. The index has risen sharply from historically low levels before the invasion of Ukraine, peaking on March 19, but appears to have stabilized around the median historical level.

Insurance Companies and the Growth of Corporate Loan Securitization

Collateralized loan obligation (CLO) issuances in the United States increased by a factor of thirteen between 2009 and 2019, with the volume of outstanding CLOs more than doubling to approach $647 billion by the end of that period. While researchers and policy makers have been investigating the impact of this growth on the cost and riskiness of corporate loans and the potential implications for financial stability, less attention has been paid to the drivers of this phenomenon. In this post, which is based on our recent paper, we shed light on the role that insurance companies have played in the growth of corporate loans’ securitization and identify the key factors behind that role.

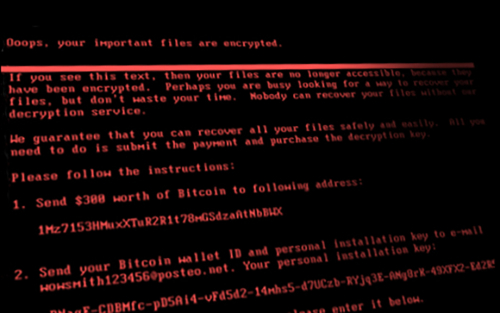

Cyberattacks and Supply Chain Disruptions

Cybercrime is one of the most pressing concerns for firms. Hackers perpetrate frequent but isolated ransomware attacks mostly for financial gains, while state-actors use more sophisticated techniques to obtain strategic information such as intellectual property and, in more extreme cases, to disrupt the operations of critical organizations. Thus, they can damage firms’ productive capacity, thereby potentially affecting their customers and suppliers. In this post, which is based on a related Staff Report, we study a particularly severe cyberattack that inadvertently spread beyond its original target and disrupted the operations of several firms around the world. More recent examples of disruptive cyberattacks include the ransomware attacks on Colonial Pipeline, the largest pipeline system for refined oil products in the U.S., and JBS, a global beef processing company. In both cases, operations halted for several days, causing protracted supply chain bottlenecks.

Measuring the Forest through the Trees: The Corporate Bond Market Distress Index

With more than $6 trillion outstanding, the U.S. corporate bond market is a significant source of funding for most large U.S. corporations. While prior literature offers a variety of measures to capture different aspects of corporate bond market functioning, there is little consensus on how to use those measures to identify periods of distress in the market as a whole. In this post, we describe the U.S. Corporate Bond Market Distress Index (CMDI), which offers a single measure to quantify joint dislocations in the primary and secondary corporate bond markets. As detailed in a new working paper, the index provides more salient information about the state of the corporate bond market relative to common measures of financial stress, thereby more accurately identifying periods of widespread dislocation in the market.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics