Does Income Inequality Affect Small Firms?

The share of income going to high-income households has increased significantly in the United States in recent decades. In 1980, the average income share of earners in the top 10 percent was around 30 percent. However, by 2015, it had surpassed 45 percent. The employment share of small firms has also declined, with a decrease of approximately 5 percentage points over the same period. In this post, we use variation across states to show a correlation between these two developments, with states having the greatest increase in the upper income share also tending to be those with the biggest job creation declines in small firms compared to large firms. One explanation for this correlation is that the increase in the income share of the highest income earners reduced deposits in small and medium-size banks from what they otherwise would have been. In doing so, this shift in income reduced the available credit for small firms, putting them at a disadvantage relative to large firms.

Financial Vulnerability and Macroeconomic Fragility

What is the effect of a hike in interest rates on the economy? Building on recent research, we argue in this post that the answer to this question very much depends on how vulnerable the financial system is. We measure financial vulnerability using a novel concept—the financial stability interest rate r** (or “r-double-star”)—and show that, empirically, the economy is more sensitive to shocks when the gap between r** and current real rates is small or negative.

Financial Fragility without Banks

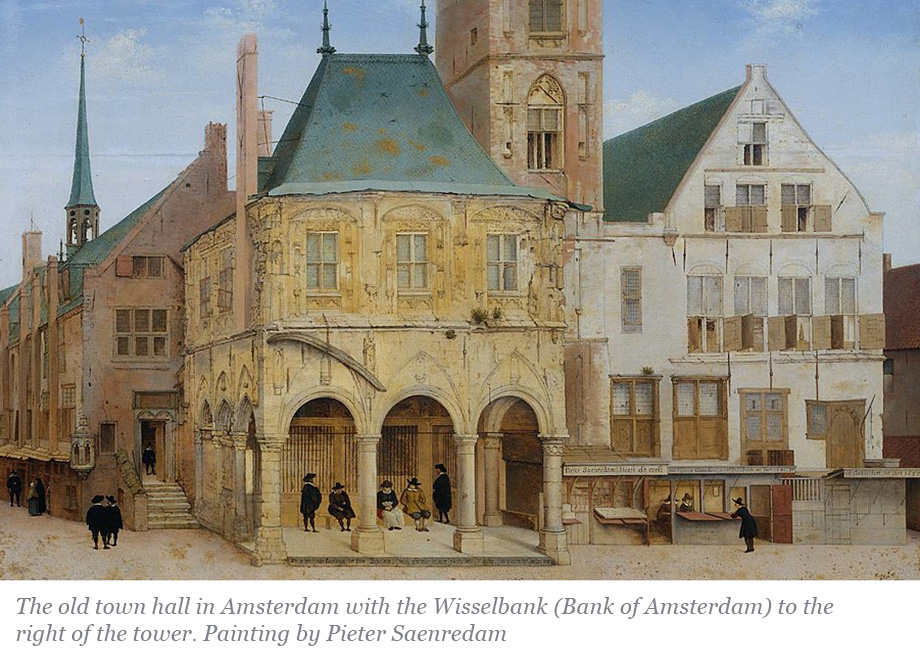

Proponents of narrow banking have argued that lender of last resort policies by central banks, along with deposit insurance and other government interventions in the money markets, are the primary causes of financial instability. However, as we show in this post, non-bank financial institutions (NBFIs) triggered a financial crisis in 1772 even though the financial system at that time had few banks and deposits were not insured. NBFIs profited from funding risky, longer-dated assets using cheap short-term wholesale funding and, when they eventually failed, authorities felt compelled to rescue the financial system.

Mitigating the Risk of Runs on Uninsured Deposits: the Minimum Balance at Risk

The incentives that drive bank runs have been well understood since the seminal work of Nobel laureates Douglas Diamond and Philip Dybvig (1983). When a bank is suspected to be insolvent, early withdrawers can get the full value of their deposits. If and when the bank runs out of funds, however, the bank cannot pay remaining depositors. As a result, all depositors have an incentive to run. The failures of Silicon Valley Bank and Signature Bank remind us that these incentives are still present for uninsured depositors, that is, those whose bank deposits are larger than deposit insurance limits. In this post, we discuss a policy proposal to reduce uninsured depositors’ incentives to run.

How Do Interest Rates (and Depositors) Impact Measures of Bank Value?

The rapid rise in interest rates across the yield curve has increased the broader public’s interest in the exposure embedded in bank balance sheets and in depositor behavior more generally. In this post, we consider a simple illustration of the potential impact of higher interest rates on measures of bank franchise value.

Monetary Policy Transmission and the Size of the Money Market Fund Industry: An Update

The size of the money market fund (MMF) industry co-moves with the monetary policy cycle. In a post published in 2019, we showed that this co-movement is likely due to the stronger response of MMF yields to monetary policy tightening relative to bank deposit rates, combined with MMF shares and bank deposits being close substitutes from an investor’s perspective. In this post, we update the analysis and zoom in to the current monetary policy tightening by the Federal Reserve.

Understanding the “Inconvenience” of U.S. Treasury Bonds

The U.S. Treasury market is one of the most liquid financial markets in the world, and Treasury bonds have long been considered a safe haven for global investors. It is often believed that Treasury bonds earn a “convenience yield,” in the sense that investors are willing to accept a lower yield on them compared to other investments with the same cash flows owing to Treasury bonds’ safety and liquidity. However, since the global financial crisis (GFC), long-maturity U.S. Treasury bonds have traded at a yield consistently above the interest rate swap rate of the same maturity. The emergence of the “negative swap spread” appears to suggest that Treasury bonds are “inconvenient,” at least relative to interest rate swaps. This post dives into this Treasury “inconvenience” premium and highlights the role of dealers’ balance sheet constraints in explaining it.

How the LIBOR Transition Affects the Supply of Revolving Credit

In the United States, most commercial and industrial (C&I) lending takes the form of revolving lines of credit, known as revolvers or credit lines. For decades, like other U.S. C&I loans, credit lines were typically indexed to the London Interbank Offered Rate (LIBOR). However, since 2022, the U.S. and other developed-market economies have transitioned from credit-sensitive reference rates such as LIBOR to new risk-free rates, including the Secured Overnight Financing Rate (SOFR). This post, based on a recent New York Fed Staff Report, explores how the provision of revolving credit is likely to change as a result of the transition to a new reference rate.

Foreign Banking Organizations in the United States and the Price of Dollar Liquidity

Foreign banking organizations (FBOs) in the United States play an important role in setting the price of short-term dollar liquidity. In this post, based on remarks given at the 2022 Jackson Hole Economic Policy Symposium, we highlight FBOs’ activities in money markets and discuss how the availability of reserve balances affects these activities. Understanding the dynamics of FBOs’ business models and their balance sheet constraints helps us monitor the evolution of liquidity conditions during quantitative easing (QE) and tightening (QT) cycles.

Does Bank Monitoring Affect Loan Repayment?

Banks monitor borrowers after originating loans to reduce moral hazard and prevent loan losses. While monitoring represents an important activity of bank business, evidence on its effect on loan repayment is scant. In this post, which is based on our recent paper, we shed light on whether bank monitoring fosters loan repayment and to what extent it does so.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics