How Much Did Supply Constraints Boost U.S. Inflation?

What factors are behind the recent inflation surge has been a huge topic of debate amongst academics and policymakers. We know that pandemic-related supply constraints such as labor shortages and supply chain bottlenecks have been key factors pushing inflation higher. These bottlenecks started with the pandemic (lockdowns, sick workers) and were made worse by the push arising from increased demand caused by very expansionary fiscal and monetary policy. Our analysis of the relative importance of supply-side versus demand-side factors finds 60 percent of U.S. inflation over the 2019-21 period was due to the jump in demand for goods while 40 percent owed to supply-side issues that magnified the impact of this higher demand.

The Effect of Inequality on the Transmission of Monetary and Fiscal Policy

Monetary policy can have a meaningful impact on inequality, as recent theoretical and empirical studies suggest. In light of this, how should policy be conducted? And how does inequality affect the transmission of monetary policy? These are the topics covered in the second part of the recent symposium on “Heterogeneity in Macroeconomics: Implications for Policy,” hosted by the new Applied Macroeconomics and Econometrics Center (AMEC) of the New York Fed on November 12.

Stimulus, Savings, and Inflation: The Top Five Liberty Street Economics Posts of 2021

New York Fed researchers tackled a wide array of topics on Liberty Street Economics (LSE) over the past year, with the myriad effects of the pandemic—on supply chains, the banking system, and inequality, for example—remaining a major area of focus. Judging by the list below, LSE readers were particularly interested in understanding what comes next: the most-viewed posts of the year analyze households’ use of stimulus payments, the implications of lockdown-period savings, the risk of a new housing bubble, the compression of the breakeven inflation curve, and the potential roles that central banks could play in the digital currency sphere. As the year draws to a close, take a look back at the top five posts of 2021.

Is the United States Relying on Foreign Investors to Finance Its Bigger Budget Deficit?

The fiscal packages passed in 2020 and 2021 to help the economy cope with the pandemic caused a dramatic increase in federal government borrowing. One might have expected that foreign investors were important buyers of this new debt, but that was not the case. They were instead net sellers of Treasury securities. Still, the amount of money flowing into the United States increased last year, which helped fund the government’s borrowing, if only indirectly. The upturn in inflows, though, was quite modest as a surge in domestic personal saving largely covered the government’s heightened borrowing needs. How the reliance on foreign funds changes in 2021, when the government deficit will again be quite elevated, will depend on whether domestic personal saving remains high.

Up on Main Street

The Main Street Lending Program was the last of the facilities launched by the Fed and Treasury to support the flow of credit during the COVID-19 pandemic of 2020-21. The others primarily targeted Wall Street borrowers; Main Street was for smaller firms that rely more on banks for credit. It was a complicated program that worked by purchasing loans and sharing risk with lenders. Despite its delayed launch, Main Street purchased more debt than any other facility and was accelerating when it closed in January 2021. This post first locates Main Street in the constellation of COVID-19 credit programs, then looks in detail at its design and usage with an eye toward any future programs.

Consumers Expect Modest Increase in Spending Growth and Continued Government Support

A New Reserves Regime? COVID‑19 and the Federal Reserve Balance Sheet

Aggregate reserves declined from nearly $3 trillion in August 2014 to $1.4 trillion in mid-September 2019, as the Federal Reserve normalized its balance sheet. This decline came to a halt in September 2019 when the Federal Reserve responded to turmoil in short-term money markets, with reserves fluctuating around $1.6 trillion in the early months of 2020. Then, in response to the COVID-19 pandemic, the Federal Reserve dramatically expanded its balance sheet, both directly, through outright purchases and repurchase agreements, and indirectly, as a consequence of the facilities to support market functioning and the flow of credit to the real economy. In this post, we characterize the increase in reserves between March and June 2020, describing changes to the distribution and concentration of reserves.

Municipal Debt Markets and the COVID‑19 Pandemic

In March, with the outbreak of the COVID-19 pandemic in the United States, the market for municipal securities was severely stressed: mutual fund redemptions sparked unprecedented selling of municipal securities, yields increased sharply, and issuance dried up. In this post, we describe the evolution of municipal bond market conditions since the onset of the COVID-19 crisis. We show that conditions in municipal markets have improved significantly, in part a result of the announcement and implementation of several Federal Reserve facilities. Yields have decreased substantially, mutual funds have received significant inflows, and issuance has rebounded. These improvements in municipal market conditions help ensure that state and local governments have better access to funding for critical capital investments.

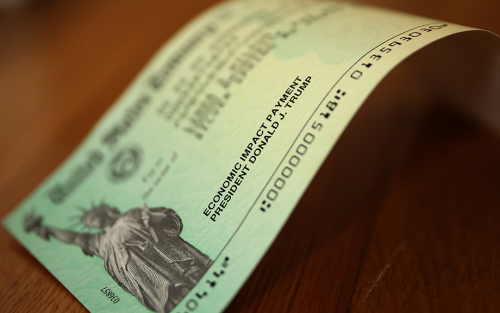

Consumers Increasingly Expect Additional Government Support amid COVID‑19 Pandemic

The New York Fed’s Center for Microeconomic Data released results today from its April 2020 SCE Public Policy Survey, which provides information on consumers’ expectations regarding future changes to a wide range of fiscal and social insurance policies and the potential impact of these changes on their households. These data have been collected every four months since October 2015 as part of our Survey of Consumer Expectations (SCE). Given the ongoing COVID-19 pandemic, households face significant uncertainty about their personal situations and the general economic environment when forming plans and making decisions. Tracking individuals’ subjective beliefs about future government policy changes is important for understanding and predicting their behavior in terms of spending and labor supply, which will be crucial in forecasting the economic recovery in the months ahead.

Helping State and Local Governments Stay Liquid

On April 9, the Federal Reserve announced up to $2.3 trillion in new support for the economy in response to the coronavirus pandemic. Among the initiatives is the Municipal Liquidity Facility (MLF), intended to support state and local governments. The details of the facility are described in the term sheet. The state and local sector is a unique but very important part of the economy. This post lays out some of the economics of the sector and the needs that the facility intends to satisfy.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics