Banks versus Hurricanes

The impacts of hurricanes analyzed in the previous post in this series may be far-reaching in the Second District. In a new Staff Report, we study how banks in Puerto Rico fared after Hurricane Maria struck the island on September 17, 2017. Maria makes a worst case in some respects because the economy and banks there were vulnerable beforehand, and because Maria struck just two weeks after Hurricane Irma flooded the island. Despite the immense destruction and disruption Maria caused, we find that the island’s economy and banks recovered surprisingly quickly. We discuss the various protections—including homeowners’ insurance, federal aid, and mortgage guarantees—that helped buttress the island’s economy and banks.

How Do Banks Lend in Inaccurate Flood Zones in the Fed’s Second District?

In our previous post, we identified the degree to which flood maps in the Federal Reserve’s Second District are inaccurate. In this post, we use our data on the accuracy of flood maps to examine how banks lend in “inaccurately mapped” areas, again focusing on the Second District in particular. We find that banks are seemingly aware of poor-quality flood maps and are generally less likely to lend in such regions, thereby demonstrating a degree of flood risk management or risk aversion. This propensity to avoid lending in inaccurately mapped areas can be seen in jumbo as well as non-jumbo loans, once we account for a series of confounding effects. The results for the Second District largely mirror those for the rest of the nation, with inaccuracies leading to similar reductions in lending, especially among non-jumbo loans.

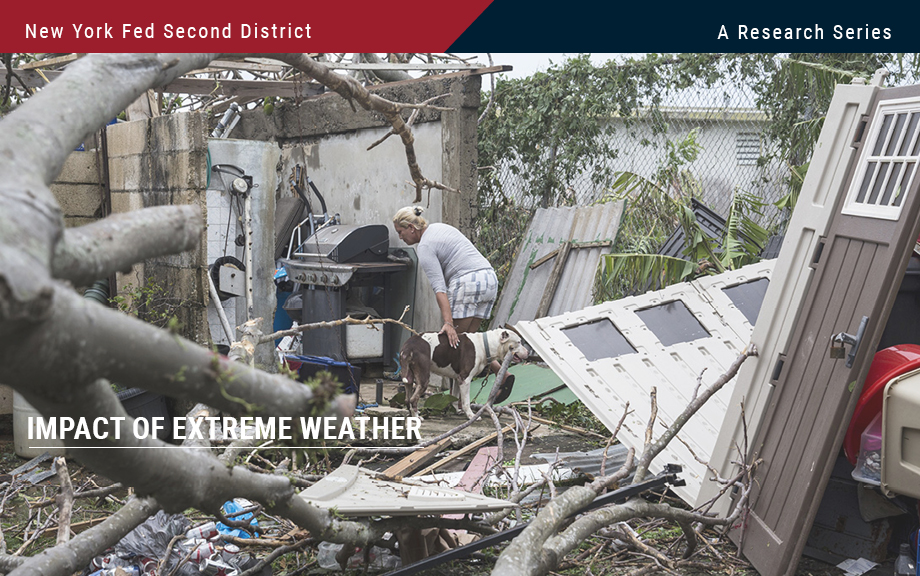

Blog Series on the Economic and Financial Impacts of Extreme Weather Events in the Fed’s Second District

The frequency and ferocity of extreme weather events, such as flooding, storms, and deadly heat waves, have been on the rise in recent years. These climate events, along with human adaption to cope with them, may have large effects on the economy and financial markets. It is therefore paramount to provide research about the economy’s vulnerability to climate events for policymakers, households, financial institutions, and other players in the world economy to make informed decisions. In the coming days, we are going to present a series of nine posts that attempt to take a step in this direction while focusing on the Federal Reserve System’s Second District (NY, northern NJ, southwest CT, Puerto Rico, and the U.S. Virgin Islands). The twelve Federal Reserve Districts are depicted in this map.

Banking System Vulnerability: 2023 Update

The bank failures that occurred in March 2023 highlighted how unrealized losses on securities can make banks vulnerable to a sudden loss of funding. This risk, which materialized following the rapid rise in interest rates that began in early 2022, underscores the importance of monitoring the vulnerabilities of the banking system. In this post, as in previous years, we provide an update of four analytical models aimed at capturing different aspects of vulnerability of the U.S. banking system, with data through the second quarter of 2023. In addition, we discuss changes made to the methodology based on the lessons from March 2023 and assess how the system-level vulnerability has evolved.

How Exposed Are U.S. Banks’ Loan Portfolios to Climate Transition Risks?

Much of the work on climate risk has focused on the physical effects of climate change, with less attention devoted to “transition risks” related to negative economic effects of enacting climate-related policies and phasing out high-emitting technologies. Further, most of the work in this area has measured transition risks using backward-looking metrics, such as carbon emissions, which does not allow us to compare how different policy options will affect the economy. In a recent Staff Report, we capitalize on a new measure to study the extent to which banks’ loan portfolios are exposed to specific climate transition policies. The results show that while banks’ exposures are meaningful, they are manageable.

Measuring the Financial Stability Real Interest Rate, r**

Comparing our financial stability real interest rate, r** (“r-double-star”) with the prevailing real interest rate gives a measure of how vulnerable the economy is to financial instability. In this post, we first explain how r** can be measured, and then discuss its evolution over the last fifty years and how to interpret the recent banking turmoil within this framework.

Financial Vulnerability and Macroeconomic Fragility

What is the effect of a hike in interest rates on the economy? Building on recent research, we argue in this post that the answer to this question very much depends on how vulnerable the financial system is. We measure financial vulnerability using a novel concept—the financial stability interest rate r** (or “r-double-star”)—and show that, empirically, the economy is more sensitive to shocks when the gap between r** and current real rates is small or negative.

Banks’ Balance‑Sheet Costs and ON RRP Investment

Daily investment at the Federal Reserve’s Overnight Reverse Repo (ON RRP) facility increased from a few billion dollars in March 2021 to more than $2.3 trillion in June 2022 and has stayed above $2 trillion since then. In this post, which is based on a recent staff report, we discuss two channels—a deposit channel and a wholesale short-term debt channel—through which banks’ balance-sheet costs have increased investment by money market mutual funds (MMFs) in the ON RRP facility.

Banks Runs and Information

The collapse of Silicon Valley Bank (SVB) and Signature Bank (SB) has raised questions about the fragility of the banking system. One striking aspect of these bank failures is how the runs that preceded them reflect risks and trade-offs that bankers and regulators have grappled with for many years. In this post, we highlight how these banks, with their concentrated and uninsured deposit bases, look quite similar to the small rural banks of the 1930s, before the creation of deposit insurance. We argue that, as with those small banks in the early 1930s, managing the information around SVB and SB’s balance sheets is of first-order importance.

Bank Funding during the Current Monetary Policy Tightening Cycle

Recent events have highlighted the importance of understanding the distribution and composition of funding across banks. Market participants have been paying particular attention to the overall decline of deposit funding in the U.S. banking system as well as the reallocation of deposits within the banking sector. In this post, we describe changes in bank funding structure since the onset of monetary policy tightening, with a particular focus on developments through March 2023.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics