How Do the Fed’s MBS Holdings Affect the Economy?

In our previous post, we discussed the meaning of the term “credit allocation” and how it relates to the Federal Reserve’s holdings of agency mortgage-backed securities (MBS). We concluded that the Fed’s MBS holdings do not pose significant credit risk but that the Fed does influence the relative market price of credit when it purchases agency MBS, and this indirectly influences decisions by investors. Today, we take the next step and discuss how the Fed’s MBS purchases affect the U.S. economy and, in particular, how the effect of MBS purchases can differ from the effect of purchases of Treasury securities.

Hey, Economist! Outgoing New York Fed President Bill Dudley on FOMC Preparation and Thinking Like an Economist

Bill Dudley will soon turn over the keys to the vault—so to speak. But before his tenure in office ends after nine years as president of the New York Fed, Liberty Street Economics caught up with him to capture his parting reflections on economic research, FOMC preparation, and leadership. Publications editor Trevor Delaney recently caught up with Dudley.

The Fed’s Balance Sheet, Night Lights, and the Other Top LSE Posts of 2017

In the spirit of this season of year-end lists of accomplishments, Liberty Street Economics offers a roundup of our most viewed posts. Our readers continued to gravitate toward timely, topical posts; our most popular explained how the Fed manages its enlarged balance sheet—a major focus of the FOMC, Congress, markets, and economists. Prompted by reader questions in response to their first post, the authors also penned a follow-up post. Another hit this year described an innovative indicator of economic growth—night light intensity measured via satellite—and used it to fact-check official Chinese growth estimates.

A Closer Look at the Fed’s Balance Sheet Accounting

An earlier post on how the Fed changes the size of its balance sheet prompted several questions from readers about the Federal Reserve’s accounting of asset purchases and the payment of principal by the Treasury on Treasury securities owned by the Fed. In this post, we provide a more detailed explanation of the accounting rules that govern these transactions.

Just Released: Updated SOMA Portfolio and Income Projections

The Federal Reserve Bank of New York’s Markets Group today published a report presenting updated staff projections [LINK TO REPORT] for the future path of domestic securities held in the System Open Market Account (SOMA) and portfolio-related income. The updated projections incorporate very recent information and are provided as a tool for the public to further understand factors affecting the evolution of the Federal Reserve’s balance sheet.

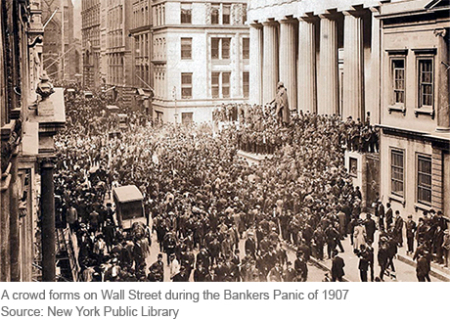

The Final Crisis Chronicle: The Panic of 1907 and the Birth of the Fed

The panic of 1907 was among the most severe we’ve covered in our series and also the most transformative, as it led to the creation of the Federal Reserve System. Also known as the “Knickerbocker Crisis,” the panic of 1907 shares features with the 2007-08 crisis, including “shadow banks” in the form high-flying, less-regulated trusts operating beyond the safety net of the time, and a pivotal “Lehman moment” when Knickerbocker Trust, the second-largest trust in the country, was allowed to fail after J.P. Morgan refused to save it.

A Closer Look at the Federal Reserve’s Securities Lending Program

The Monetary Policy Advice Process at the New York Fed

Research economists discuss their process for providing advice on monetary policy to the New York Fed president ahead of FOMC meetings.

Measuring Settlement Fails

n June 2014, settlement fails of U.S. Treasury securities reached their highest level since the implementation of the Treasury fails charge in May 2009, attracting significant attention from market participants.

Transparency and Sources of Information on the Federal Reserve’s Operations, Income, and Balance Sheet

This week-long series examined the evolution of the Federal Reserve’s securities portfolio and its performance over time.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics