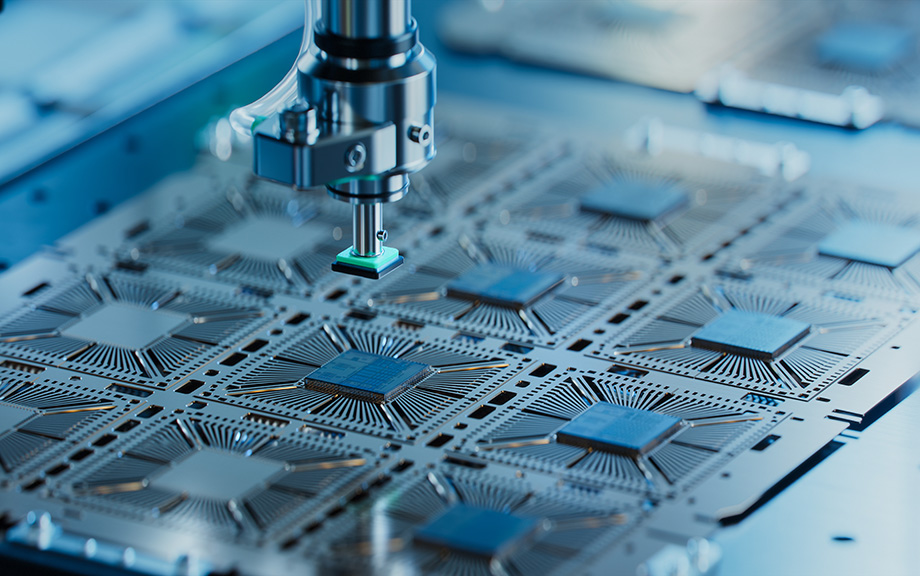

The Anatomy of Export Controls

Governments increasingly use export controls to limit the spread of domestic cutting-edge technologies to other countries. The sectors that are currently involved in this geopolitical race include semiconductors, telecommunications, and artificial intelligence. Despite their growing adoption, little is known about the effect of export controls on supply chains and the productive sector at large. Do export controls induce a selective decoupling of the targeted goods and sectors? How do global customer-supplier relations react to export controls? What are their effects on the productive sector? In this post, which is based on a related staff report, we analyze the supply chain reconfiguration and associated financial and real effects following the imposition of export controls by the U.S. government.

What Happens to U.S. Activity and Inflation if China’s Property Sector Leads to a Crisis?

A previous post explored the potential implications for U.S. growth and inflation of a manufacturing-led boom in China. This post considers spillovers to the U.S. from a downside scenario, one in which China’s ongoing property sector slump takes another leg down and precipitates an economic hard landing and financial crisis.

What if China Manufactures a Sugar High?

While the slump in China’s property sector has been steep, Chinese policymakers have responded to the falloff in property activity with policies designed to spur activity in the manufacturing sector. The apparent hope is that a pivot toward production-intensive growth can help lift the Chinese economy out of its current doldrums, which include weak household demand, high levels of debt, and demographic and political headwinds to growth. In a series of posts, we consider the implications of two alternative Chinese policy scenarios for the risks to the U.S. outlook for real activity and inflation over the next two years. Here, we consider the impact of a scenario in which a credit-fueled boom in manufacturing activity produces higher-than-expected economic growth in China. A key finding is that such a boom would put meaningful upward pressure on U.S. inflation.

Can Electric Cars Power China’s Growth?

China’s aggressive policies to develop its battery-powered electric vehicle (BEV) industry have been successful in making the country the dominant producer of these vehicles worldwide. Going forward, BEVs will likely claim a growing share of global motor vehicle sales, helped along by subsides and mandates implemented in the United States, Europe, and elsewhere. Nevertheless, China’s success in selling BEVs may not contribute much to its GDP growth, owing both to the maturity of its motor vehicle sector and the strong tendency for countries to protect this high-profile industry.

Towards Increasing Complexity: The Evolution of the FX Market

Editor’s note: Since this post was first published, the first paragraph under the “Looking Forward” subhead has been updated to clarify the expected increase in the speed of FX transaction settlements. (Jan. 25, 2:30 p.m.)

The foreign exchange market has evolved extensively over time, undergoing important shifts in the types of market participants and the mix of instruments traded, within a trading ecosystem that has become increasingly complex. In this post, we discuss fundamental changes in this market over the past twenty-five years and highlight some of the implications for its future evolution. Our analysis suggests that maintaining a healthy price discovery process and fostering a level playing field among participants are areas to watch for challenges. The consequences of the evolution of the FX market—well beyond those anticipated twenty-five years ago—remain active areas of research and policy consideration.

Does Trade Uncertainty Affect Bank Lending?

The recent era of global trade expansion is over. Faced with increased geopolitical risk, fragile foreign supply chains, and uncertainties in the international trade environment, firms are postponing entry into foreign markets and pulling back from foreign activities (IMF 2023). Besides its direct effects on real activity, the recent rise in trade uncertainty has potentially important implications for the financial sector. This post describes how the lending activities of U.S. banks were affected by the rise in trade uncertainty during the 2018-19 “trade war.” In particular, banks that were more exposed to trade uncertainty contracted lending to all of their domestic nonfinancial business borrowers, regardless of whether these borrowers were facing high or low uncertainty themselves. Furthermore, banks’ lending strategies exhibited the type of “wait-and-see” behavior usually found in corporate firms facing investment decisions under uncertainty, and the lending contraction was larger for those banks that were more financially constrained.

Can China Catch Up with Greece?

China’s leader Xi Jinping recently laid out the goal of reaching the per capita income of “a mid-level developed country by 2035.” Is this goal likely to be achieved? Not in our view. Continued rapid growth faces mounting headwinds from population aging and from diminishing returns to China’s investment-centered growth model. Additional impediments to growth appear to be building, including a turn toward increased state management of the economy, the crystallization of legacy credit issues in real estate and other sectors, and limits on access to key foreign technologies. Even given generous assumptions concerning future growth fundamentals, China appears likely to close only a fraction of the gap with high-income countries in the years ahead.

Spending Down Pandemic Savings Is an “Only‑in‑the‑U.S.” Phenomenon

Household saving soared in the United States and other high-income economies during the pandemic, as consumers cut back on spending while government policies supported incomes. More recently, saving behavior has diverged, with the U.S. saving rate dropping below its pre-pandemic average while saving rates elsewhere have remained above their pre-pandemic averages. As a result, U.S. consumers have been spending down the “excess savings” built up during the pandemic while the excess savings abroad remain untapped. This divergent behavior helps explain why U.S. GDP has returned to its pre-pandemic trend path even as GDP levels in other high-income economies continue to run well below trend.

Why Are China’s Households in the Doldrums?

A perennial challenge with China’s growth model has been overly high investment spending relative to GDP and unusually low consumer spending, something which China has long struggled to rebalance. As China attempts to move away from credit-intensive, investment-focused growth, the economy’s growth will have to rely on higher consumer spending. However, a prolonged household borrowing binge, COVID scarring and a deep slump in the property market in China have damaged household balance sheets and eroded consumer sentiment. In this post, we examine the impact of recent shocks on Chinese household behavior for clues around the outlook for reviving consumption and economic growth in China.

2nd Annual International Roles of the U.S. Dollar Conference

The U.S. dollar plays a central role in the global economy. In addition to being the most widely used currency in foreign exchange transactions, it represents the largest share in official reserves, international debt securities and loans, cross-border payments, and trade invoicing. The ubiquity of the U.S. dollar in global transactions reflects several key factors, including the depth and liquidity of U.S. capital markets, the size of the U.S. economy, the relatively low cost of converting dollars into other currencies, and an enduring confidence in the U.S. legal system and its institutions.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics