Deciphering the Disinflation Process

U.S. inflation surged in the early post-COVID period, driven by several economic shocks such as supply chain disruptions and labor supply constraints. Following its peak at 6.6 percent in September 2022, core consumer price index (CPI) inflation has come down rapidly over the last two years, falling to 3.6 percent recently. What explains the rapid shifts in U.S. inflation dynamics? In a recent paper, we show that the interaction between supply chain pressures and labor market tightness amplified the inflation surge in 2021. In this post, we argue that these same forces that drove the nonlinear rise in inflation have worked in reverse since late 2022, accelerating the disinflationary process. The current episode contrasts with periods where the economy was hit by shocks to either imported inputs or to labor alone.

Supply Chain Disruptions Have Eased, But Remain a Concern

Supply chain disruptions became a major headache for businesses in the aftermath of the pandemic. Indeed, in October 2021, nearly all firms in our regional business surveys reported at least some difficulty obtaining the supplies they needed. These supply chain disruptions were a key contributor to the surge in inflation that occurred as the economy recovered from the pandemic recession. In this post, we present new measures of supply availability from our Business Leaders Survey and Empire State Manufacturing Survey that closely track the New York Fed’s Global Supply Chain Pressure Index (GSCPI). We will begin publishing these data on a monthly basis starting in June. These indexes indicate that supply availability had generally been improving since early 2023, but over the past couple of months, improvement has stalled. This trend is concerning since our May Supplemental Survey indicates that between a third and a half of businesses in the region are experiencing difficulties obtaining supplies, and many are reducing operations and raising prices to compensate, though to a lesser extent than a few years ago.

The Anatomy of Export Controls

Editor's note: We corrected the first chart in this post to include missing data for the number of affected U.S. suppliers in 2016 in the histogram. Chart data is available for download via link at the foot of the post. (June 12)

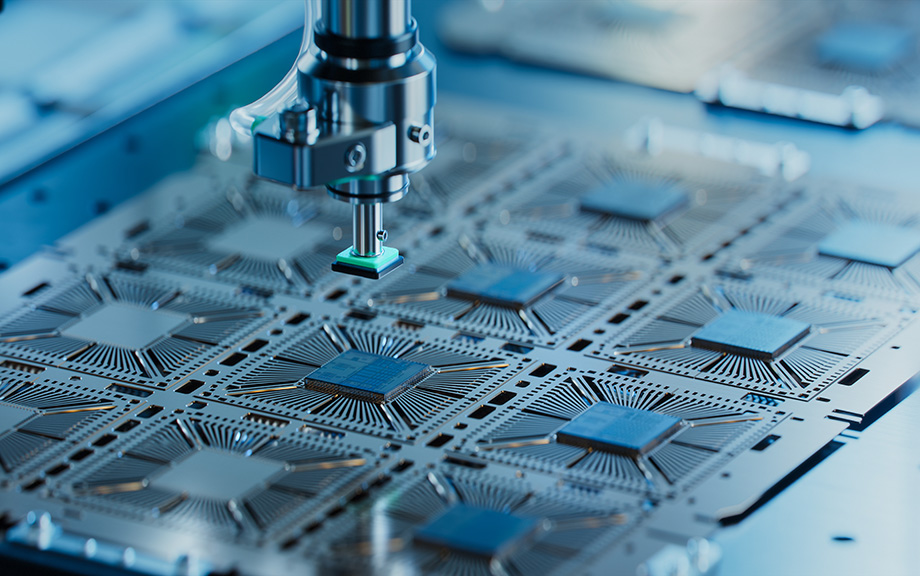

Governments increasingly use export controls to limit the spread of domestic cutting-edge technologies to other countries. The sectors that are currently involved in this geopolitical race include semiconductors, telecommunications, and artificial intelligence. Despite their growing adoption, little is known about the effect of export controls on supply chains and the productive sector at large. Do export controls induce a selective decoupling of the targeted goods and sectors? How do global customer-supplier relations react to export controls? What are their effects on the productive sector? In this post, which is based on a related staff report, we analyze the supply chain reconfiguration and associated financial and real effects following the imposition of export controls by the U.S. government.

Global Supply Chains and U.S. Import Price Inflation

Inflation around the world increased dramatically with the reopening of economies following COVID-19. After reaching a peak of 11 percent in the second quarter of 2021, world trade prices dropped by more than five percentage points by the middle of 2023. U.S. import prices followed a similar pattern, albeit with a lower peak and a deeper trough. In a new study, we investigate what drove these price movements by using information on the prices charged for products shipped from fifty-two exporters to fifty-two importers, comprising more than twenty-five million trade flows. We uncover several patterns in the data: (i) From 2021:Q1 to 2022:Q2, almost all of the growth in U.S. import prices can be attributed to global factors, that is, trends present in most countries; (ii) at the end of 2022, U.S. import price inflation started to be driven by U.S. demand factors; (iii) in 2023, foreign suppliers to the U.S. market caught up with demand and account for the decline in import price inflation, with a significant role played by China.

The Dollar’s Imperial Circle

The importance of the U.S. dollar in the context of the international monetary system has been examined and studied extensively. In this post, we argue that the dollar is not only the dominant global currency but also a key variable affecting global economic conditions. We describe the mechanism through which the dollar acts as a procyclical force, generating what we dub the “Dollar’s Imperial Circle,” where swings in the dollar govern global macro developments.

How Much Can GSCPI Improvements Help Reduce Inflation?

Inflationary pressures—their determinants and evolution—continue to dominate policy discussions. In this post, we provide a simple framework to analyze the determinants of different measures of inflation and use it to lay out a risk-scenario analysis. We find that global supply factors captured by the New York Fed’s Global Supply Chain Pressure Index (GSCPI) are strongly associated with inflationary developments measured by the producer price index (PPI) and by the c0nsumer price index (CPI). Under the assumption that the GSCPI falls back to its historical average over twelve months, our model would project a substantial easing of consumer price inflation over 2023 to below 4.0 percent. The normalization of the GSCPI would then be consistent with a return of inflation to levels consistent with a soft-landing scenario.

How Have Swings in Demand Affected Global Supply Chain Pressures?

In a January 2022 post, we first presented the Global Supply Chain Pressure Index (GSCPI), a parsimonious global measure designed to capture supply chain disruptions using a range of indicators. The spirit of our index was to isolate supply factors, such as shutdowns in response to the pandemic, that put pressure on the global supply chain. In this post, we describe an auxiliary index, the Net GSCPI, which differs from the GSCPI by not filtering out demand factors. This “net” index is meant to capture global supply chain stress from both the supply and demand sides. Our analysis documents that the net index is currently below its historical average, unlike the original index, due to both the easing of supply constraints and a contraction in global demand.

Global Supply Chain Pressure Index: The China Factor

In a January 2022 post, we first presented the Global Supply Chain Pressure Index (GSCPI), a parsimonious global measure designed to capture supply chain disruptions using a range of indicators. In this post, we review GSCPI readings through December 2022, and then briefly discuss the drivers of recent moves in the index. While supply chain disruptions have significantly diminished over the course of 2022, the reversion of the index toward a normal historical range has paused over the past three months. Our analysis attributes the recent pause largely to the pandemic in China amid an easing of “Zero COVID” policies.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics