Why Do Banks Fail? Bank Runs Versus Solvency

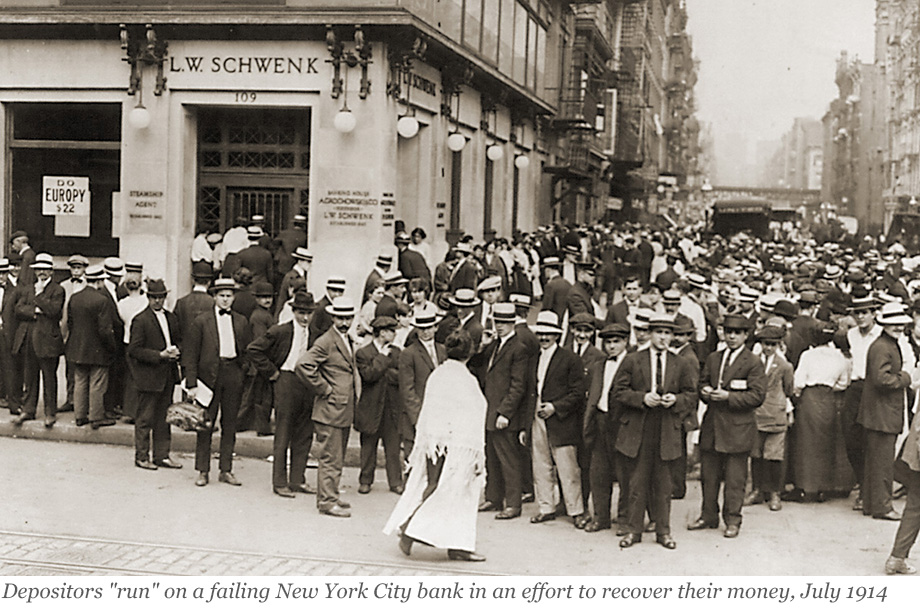

Evidence from a 160-year-long panel of U.S. banks suggests that the ultimate cause of bank failures and banking crises is almost always a deterioration of bank fundamentals that leads to insolvency. As described in our previous post, bank failures—including those that involve bank runs—are typically preceded by a slow deterioration of bank fundamentals and are hence remarkably predictable. In this final post of our three-part series, we relate the findings discussed previously to theories of bank failures, and we discuss the policy implications of our findings.

Why Do Banks Fail? The Predictability of Bank Failures

Can bank failures be predicted before they happen? In a previous post, we established three facts about failing banks that indicated that failing banks experience deteriorating fundamentals many years ahead of their failure and across a broad range of institutional settings. In this post, we document that bank failures are remarkably predictable based on simple accounting metrics from publicly available financial statements that measure a bank’s insolvency risk and funding vulnerabilities.

Why Do Banks Fail? Three Facts About Failing Banks

Why do banks fail? In a new working paper, we study more than 5,000 bank failures in the U.S. from 1865 to the present to understand whether failures are primarily caused by bank runs or by deteriorating solvency. In this first of three posts, we document that failing banks are characterized by rising asset losses, deteriorating solvency, and an increasing reliance on expensive noncore funding. Further, we find that problems in failing banks are often the consequence of rapid asset growth in the preceding decade.

What Happens to U.S. Activity and Inflation if China’s Property Sector Leads to a Crisis?

A previous post explored the potential implications for U.S. growth and inflation of a manufacturing-led boom in China. This post considers spillovers to the U.S. from a downside scenario, one in which China’s ongoing property sector slump takes another leg down and precipitates an economic hard landing and financial crisis.

What if China Manufactures a Sugar High?

While the slump in China’s property sector has been steep, Chinese policymakers have responded to the falloff in property activity with policies designed to spur activity in the manufacturing sector. The apparent hope is that a pivot toward production-intensive growth can help lift the Chinese economy out of its current doldrums, which include weak household demand, high levels of debt, and demographic and political headwinds to growth. In a series of posts, we consider the implications of two alternative Chinese policy scenarios for the risks to the U.S. outlook for real activity and inflation over the next two years. Here, we consider the impact of a scenario in which a credit-fueled boom in manufacturing activity produces higher-than-expected economic growth in China. A key finding is that such a boom would put meaningful upward pressure on U.S. inflation.

The Global Dash for Cash in March 2020

The economic disruptions associated with the COVID-19 pandemic sparked a global dash-for-cash as investors sold securities rapidly. This selling pressure occurred across advanced sovereign bond markets and caused a deterioration in market functioning, leading to a number of central bank actions. In this post, we highlight results from a recent paper in which we show that these disruptions occurred disproportionately in the U.S. Treasury market and offer explanations for why investors’ selling pressures were more pronounced and broad-based in this market than in other sovereign bond markets.

The Fed Funds Market during the 2007‑09 Financial Crisis

The U.S. federal funds market played a central role in the financial system during the 2007-09 crisis, because it was the market which provided banks with immediate liquidity, even late in the day. Interpreting changes in fed funds rates is notoriously difficult, however, as many of the economic drivers behind the rates are simultaneously changing. In this post, I highlight results from a working paper which untangles the impact of these economic drivers and measures their respective effects on the marketplace using data over a sample period leading up to and during the financial crisis. The analysis shows that the spread between fed funds sold and bought widened because of increases in counterparty risk. Further, there was a large increase in the supply of cash into this market, suggesting that banks viewed fed funds as a relatively safe place to invest cash in a crisis environment.

Did Subprime Borrowers Drive the Housing Boom?

The role of subprime mortgage lending in the U.S. housing boom of the 2000s is hotly debated in academic literature. One prevailing narrative ascribes the unprecedented home price growth during the mid-2000s to an expansion in mortgage lending to subprime borrowers. This post, based on our recent working paper, “Villains or Scapegoats? The Role of Subprime Borrowers in Driving the U.S. Housing Boom,” presents evidence that is inconsistent with conventional wisdom. In particular, we show that the housing boom and the subprime boom occurred in different places.

Ten Years after the Crisis, Is the Banking System Safer?

In the wake of the 2007-09 financial crisis, a wide range of new regulations have been introduced to improve the stability of the banking system. But has the banking system become safer since the crisis? In this post, we provide a new perspective on this question by employing four analytical models, each measuring a different aspect of banking system vulnerability, to evaluate how system stability has evolved over the past decade.

New Report Assesses Structural Changes in Global Banking

The Committee on the Global Financial System, made up of senior officials from central banks around the world and chaired by New York Fed President William Dudley, recently released a report on “Structural Changes in Banking after the Crisis.” The report includes findings from a wide-ranging study documenting the significant structural adjustments in banking systems around the world in response to regulatory, technological, and market changes after the crisis, while also assessing their implications for financial stability, credit provision, and capital markets activity. It includes a new banking database spanning over twenty-one countries from 2000 to 2016 that could serve as a valuable reference for further analysis. Overall, the study concludes that the changed regulatory and market environment since the crisis has led banks to alter their business models and balance sheets in ways that make them more resilient but also less profitable, while continuing their role as intermediaries providing financial services to the real economy.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics