How Large Are Inflation Revisions? The Difficulty of Monitoring Prices in Real Time

With prices quickly going up after the COVID-19 pandemic, inflation releases have rarely been as present in the public debate as in recent years. However, since inflation estimates are frequently revised, how precise are the real-time data releases? In this Liberty Street Economics post, we investigate the size and nature of revisions to inflation. We find that inflation estimates for a given month can change substantially as subsequent data vintages are released. As an example, consider March 2009. With the economy contracting amid the Global Financial Crisis, the twelve-month inflation rate for personal consumption expenditures (PCE) excluding food and energy dropped from an initial estimate of 1.8 percent to 0.8 percent in the current series. The difference is dramatic and points to the difficulty of monitoring inflation in real time. Our results suggest that there is significant uncertainty in measuring inflation, and the key features of the recent spike and subsequent moderation of inflation may look quite different in hindsight once further revisions have taken place.

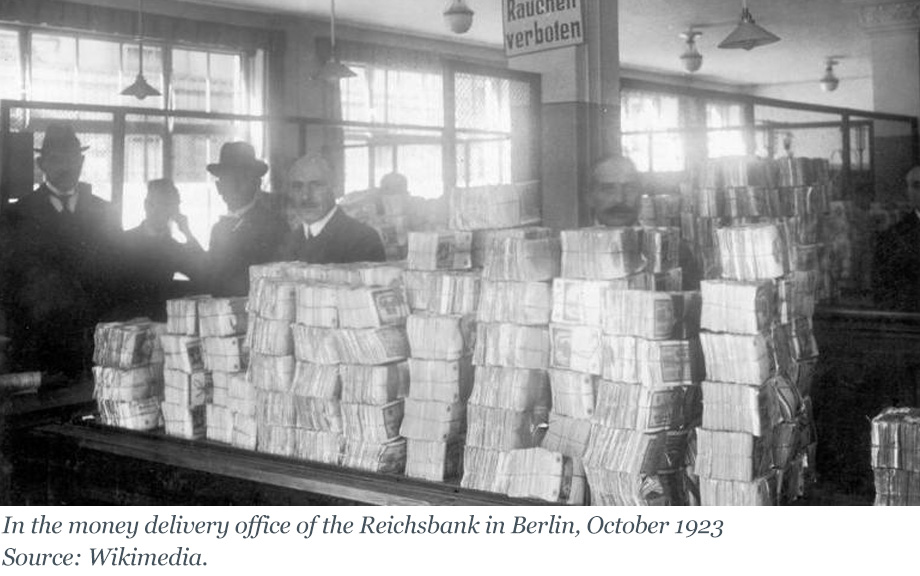

Inflating Away the Debt: The Debt‑Inflation Channel of German Hyperinflation

The recent rise in price pressures around the world has reignited interest in understanding how inflation transmits to the real economy. Economists have long recognized that unexpected surges of inflation can redistribute wealth from creditors to debtors when debt contracts are written in nominal terms (see, for example, Fisher 1933). If debtors are financially constrained, this redistribution can affect real economic activity by relaxing financing constraints. This mechanism, which we call the debt-inflation channel, is well understood theoretically (for example, Gomes, Jermann, and Schmid 2016), but there is limited empirical evidence to substantiate it. In this post, we discuss new insights from one of the key events in monetary history: the Great German Inflation of 1919-23. Because this case of inflation was both surprising and extremely high, Germany’s experience helps shed light on how high inflation impacts firms’ economic activity through the erosion of their nominal debt burdens. These insights are based on a recently released research paper.

The Credibility of Government Policies: Conference in Honor of Guillermo Calvo

Guillermo Calvo is a leading member of a group of economists who revolutionized macroeconomics by modeling how incentives and the anticipation of future policies affect aggregate outcomes. In celebration of his work, a conference was held in his honor at the Federal Reserve Bank of New York and at Columbia University on February 22-24, 2023. The conference program can be found on the event website. A longer version of this post with additional detail on the proceedings can be found here.

Elevated Rent Expectations Continue to Pressure Low‑Income Households

The Federal Reserve Bank of New York’s 2023 SCE Housing Survey, released in April, reported some novel data about expectations for home prices, interest rates, and mortgage refinancing. While the data showed a sharp drop in home price expectations, some of the most notable findings concern renters. In this post, we take a deeper dive into how renters’ expectations and financial situations have evolved over the past year. We find that both owners and renters expect rents to rise rapidly over the next year, albeit at a slower pace than last year. Furthermore, we also show that eviction expectations rose sharply over the past twelve months, and that this increase was most pronounced for those in the lowest quartile of the income distribution.

How Do Firms Adjust Prices in a High Inflation Environment?

How do firms set prices? What factors do they consider, and to what extent are cost increases passed through to prices? While these are important questions in general, they become even more salient during periods of high inflation. In this blog post, we highlight preliminary results from ongoing research on firms’ price-setting behavior, a joint project between researchers at the Federal Reserve Banks of Atlanta, Cleveland, and New York. We use a combination of open-ended interviews and a quantitative survey in our analysis. Firms reported that the strength of demand was the most important factor affecting pricing decisions in recent years, while labor costs and maintaining steady profit margins were also highly important. Using three methodological approaches, we consistently estimate a rate of cost-price passthrough in the range of 60 percent for the representative firm over 2022-23—with considerable heterogeneity in this number across firms.

MCT Update: Inflation Persistence Continued to Decline in March

This post presents an updated estimate of inflation persistence, following the release of personal consumption expenditure (PCE) price data for March 2023. The estimates are obtained by the Multivariate Core Trend (MCT), a model we introduced on Liberty Street Economics last year and covered most recently in a March post. The MCT is a dynamic factor model estimated on monthly data for the seventeen major sectors of the PCE price index. It decomposes each sector’s inflation as the sum of a common trend, a sector-specific trend, a common transitory shock, and a sector-specific transitory shock. The trend in PCE inflation is constructed as the sum of the common and the sector-specific trends weighted by the expenditure shares.

A Turning Point in Wage Growth?

The surge in wage growth experienced by the U.S. economy over the past two years is showing some tentative signs of moderation. In this post, we take a closer look at the underlying data by estimating a model designed to isolate the persistent component—or trend—of wage growth. Our central finding is that this trend may have peaked in early 2022, having experienced an earlier rise and subsequent moderation that were broad-based across sectors. We also find that wage growth seems to be moderating more slowly than the trend in services inflation.

How Much Can GSCPI Improvements Help Reduce Inflation?

Inflationary pressures—their determinants and evolution—continue to dominate policy discussions. In this post, we provide a simple framework to analyze the determinants of different measures of inflation and use it to lay out a risk-scenario analysis. We find that global supply factors captured by the New York Fed’s Global Supply Chain Pressure Index (GSCPI) are strongly associated with inflationary developments measured by the producer price index (PPI) and by the c0nsumer price index (CPI). Under the assumption that the GSCPI falls back to its historical average over twelve months, our model would project a substantial easing of consumer price inflation over 2023 to below 4.0 percent. The normalization of the GSCPI would then be consistent with a return of inflation to levels consistent with a soft-landing scenario.

What Is “Outlook‑at‑Risk?”

Editor’s note: Since this post was first published, the y-axis label in the last chart has been corrected. February 15, 9:30 a.m.

The Federal Open Market Committee (FOMC) has increased the target range for the federal funds rate by 4.50 percentage points since March 16, 2022. In tightening the stance of monetary policy, the FOMC balances the risk of inflation remaining persistently high if the economy continues to run “hot” against the risk of unemployment rising as the economy cools. In this post, we review a quantitative approach to measuring the evolution of risks to real GDP growth, the unemployment rate, and inflation that is inspired by our previous work on “Vulnerable Growth.” We find that, in February, downside risks to real GDP growth and upside risks to unemployment moderated slightly, and upside risks to inflation continued to decline.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics