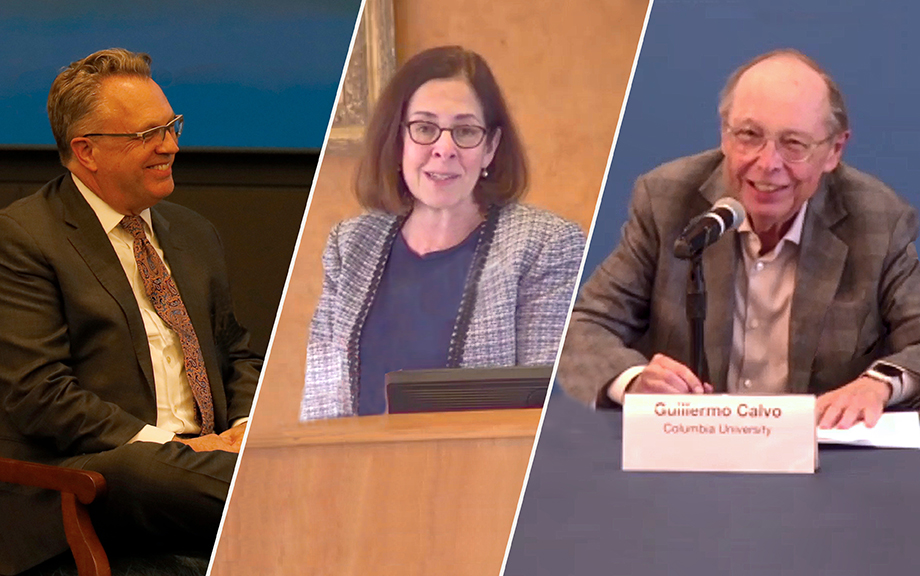

The Credibility of Government Policies: Conference in Honor of Guillermo Calvo

Guillermo Calvo is a leading member of a group of economists who revolutionized macroeconomics by modeling how incentives and the anticipation of future policies affect aggregate outcomes. In celebration of his work, a conference was held in his honor at the Federal Reserve Bank of New York and at Columbia University on February 22-24, 2023. The conference program can be found on the event website. A longer version of this post with additional detail on the proceedings can be found here.

Elevated Rent Expectations Continue to Pressure Low‑Income Households

The Federal Reserve Bank of New York’s 2023 SCE Housing Survey, released in April, reported some novel data about expectations for home prices, interest rates, and mortgage refinancing. While the data showed a sharp drop in home price expectations, some of the most notable findings concern renters. In this post, we take a deeper dive into how renters’ expectations and financial situations have evolved over the past year. We find that both owners and renters expect rents to rise rapidly over the next year, albeit at a slower pace than last year. Furthermore, we also show that eviction expectations rose sharply over the past twelve months, and that this increase was most pronounced for those in the lowest quartile of the income distribution.

How Do Firms Adjust Prices in a High Inflation Environment?

How do firms set prices? What factors do they consider, and to what extent are cost increases passed through to prices? While these are important questions in general, they become even more salient during periods of high inflation. In this blog post, we highlight preliminary results from ongoing research on firms’ price-setting behavior, a joint project between researchers at the Federal Reserve Banks of Atlanta, Cleveland, and New York. We use a combination of open-ended interviews and a quantitative survey in our analysis. Firms reported that the strength of demand was the most important factor affecting pricing decisions in recent years, while labor costs and maintaining steady profit margins were also highly important. Using three methodological approaches, we consistently estimate a rate of cost-price passthrough in the range of 60 percent for the representative firm over 2022-23—with considerable heterogeneity in this number across firms.

MCT Update: Inflation Persistence Declined Significantly in April

This post presents an updated estimate of inflation persistence, following the release of personal consumption expenditure (PCE) price data for April 2023. The estimates are obtained by the Multivariate Core Trend (MCT), a model we introduced on Liberty Street Economics last year and covered most recently in a May post. The MCT is a dynamic factor model estimated on monthly data for the seventeen major sectors of the PCE price index. It decomposes each sector’s inflation as the sum of a common trend, a sector-specific trend, a common transitory shock, and a sector-specific transitory shock. The trend in PCE inflation is constructed as the sum of the common and the sector-specific trends weighted by the expenditure shares.

Financial Stability and Interest Rates

In a recent research paper we argue that interest rates have very different consequences for current versus future financial stability. In the short run, lower real rates mean higher asset prices and hence higher net worth for financial institutions. In the long run, lower real rates lead intermediaries to shift their portfolios toward risky assets, making them more vulnerable over time. In this post, we use a model to highlight the challenging trade-offs faced by policymakers in setting interest rates.

First‑Time Buyers Did Not Drive Strong House Price Appreciation in 2021

In May 2022, Sam Khater—chief economist for Freddie Mac—argued that a surge in first-time buyers had been an important driver of the housing market the previous year. In contrast, using data from the New York Fed Consumer Credit Panel, we find that the share of home purchases by first-time buyers fell in 2021. This suggests that other factors were important to the rapid increase in house prices in 2021.

MCT Update: Inflation Persistence Continued to Decline in March

This post presents an updated estimate of inflation persistence, following the release of personal consumption expenditure (PCE) price data for March 2023. The estimates are obtained by the Multivariate Core Trend (MCT), a model we introduced on Liberty Street Economics last year and covered most recently in a March post. The MCT is a dynamic factor model estimated on monthly data for the seventeen major sectors of the PCE price index. It decomposes each sector’s inflation as the sum of a common trend, a sector-specific trend, a common transitory shock, and a sector-specific transitory shock. The trend in PCE inflation is constructed as the sum of the common and the sector-specific trends weighted by the expenditure shares.

MCT Update: Inflation Persistence Declined Modestly in February

This post presents an updated estimate of inflation persistence, following the release of personal consumption expenditure (PCE) price data for February 2023. The estimates are obtained by the Multivariate Core Trend (MCT), a model we introduced on Liberty Street Economics last year and covered most recently in a February post. The MCT is a dynamic factor model estimated on monthly data for the seventeen major sectors of the PCE price index. It decomposes each sector’s inflation as the sum of a common trend, a sector-specific trend, a common transitory shock, and a sector-specific transitory shock. The trend in PCE inflation is constructed as the sum of the common and the sector-specific trends weighted by the expenditure shares.

The New York Fed DSGE Model Forecast—March 2023

This post presents an update of the economic forecasts generated by the Federal Reserve Bank of New York’s dynamic stochastic general equilibrium (DSGE) model. We describe very briefly our forecast and its change since December 2022. Note that this forecast was produced on February 27, and hence should be viewed as reflecting the state of the economy before the current banking sector turmoil.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics