Do Large Firms Generate Positive Productivity Spillovers?

Numerous studies have documented the rising dominance of large firms over the last few decades in many industrialized countries. Many research papers have focused on the potential negative effects of this increased market concentration, raising concerns about market power in both labor and product markets. In a new study, we investigate whether large firms also generate positive effects. Our research shows that large firms generate significant positive total factor productivity (TFP) spillovers to their domestic suppliers. To date, these types of spillovers have only been identified for multinational enterprises located in developing countries. Using firm-to-firm transaction data for an industrialized country, Belgium, we find that large domestic firms, as well as multinationals, generate positive TFP spillovers.

Spending Down Pandemic Savings Is an “Only‑in‑the‑U.S.” Phenomenon

Household saving soared in the United States and other high-income economies during the pandemic, as consumers cut back on spending while government policies supported incomes. More recently, saving behavior has diverged, with the U.S. saving rate dropping below its pre-pandemic average while saving rates elsewhere have remained above their pre-pandemic averages. As a result, U.S. consumers have been spending down the “excess savings” built up during the pandemic while the excess savings abroad remain untapped. This divergent behavior helps explain why U.S. GDP has returned to its pre-pandemic trend path even as GDP levels in other high-income economies continue to run well below trend.

The New York Fed DSGE Model Forecast— September 2023

This post presents an update of the economic forecasts generated by the Federal Reserve Bank of New York’s dynamic stochastic general equilibrium (DSGE) model. We describe very briefly our forecast and its change since June 2023. As usual, we wish to remind our readers that the DSGE model forecast is not an official New York Fed forecast, but only an input to the Research staff’s overall forecasting process. For more information about the model and variables discussed here, see our DSGE model Q & A.

Reintroducing the New York Fed Staff Nowcast

“Nowcasts” of GDP growth are designed to track the economy in real time by incorporating information from an array of indicators as they are released. In April 2016, the New York Fed’s Research Group launched the New York Fed Staff Nowcast, a dynamic factor model that generated estimates of current quarter GDP growth at a weekly frequency. The onset of the COVID-19 pandemic sparked widespread economic disruptions—and unprecedented fluctuations in the economic data that flow into the Staff Nowcast. This posed significant challenges to the model, leading to the suspension of publication in September 2021. Taking advantage of recent developments in time-series econometrics, we have since developed a more robust version of the Staff Nowcast model, one that better handles data volatility. In this post, we discuss the model’s new features, present estimates of current quarter GDP growth, and evaluate how the Staff Nowcast would have performed during the pandemic period. Today’s post marks the resumption of regular New York Fed Staff Nowcast releases, to be published each Friday.

How Large Are Inflation Revisions? The Difficulty of Monitoring Prices in Real Time

With prices quickly going up after the COVID-19 pandemic, inflation releases have rarely been as present in the public debate as in recent years. However, since inflation estimates are frequently revised, how precise are the real-time data releases? In this Liberty Street Economics post, we investigate the size and nature of revisions to inflation. We find that inflation estimates for a given month can change substantially as subsequent data vintages are released. As an example, consider March 2009. With the economy contracting amid the Global Financial Crisis, the twelve-month inflation rate for personal consumption expenditures (PCE) excluding food and energy dropped from an initial estimate of 1.8 percent to 0.8 percent in the current series. The difference is dramatic and points to the difficulty of monitoring inflation in real time. Our results suggest that there is significant uncertainty in measuring inflation, and the key features of the recent spike and subsequent moderation of inflation may look quite different in hindsight once further revisions have taken place.

The Evolution of Short‑Run r* after the Pandemic

This post discusses the evolution of the short-run natural rate of interest, or short-run r*, over the past year and a half according to the New York Fed DSGE model, and the implications of this evolution for inflation and output projections. We show that, from the model’s perspective, short-run r* has increased notably over the past year, to some extent outpacing the large increase in the policy rate. One implication of these findings is that the drag on the economy from recent monetary policy tightening may have been limited, rationalizing why economic conditions have remained relatively buoyant so far despite the elevated level of interest rates.

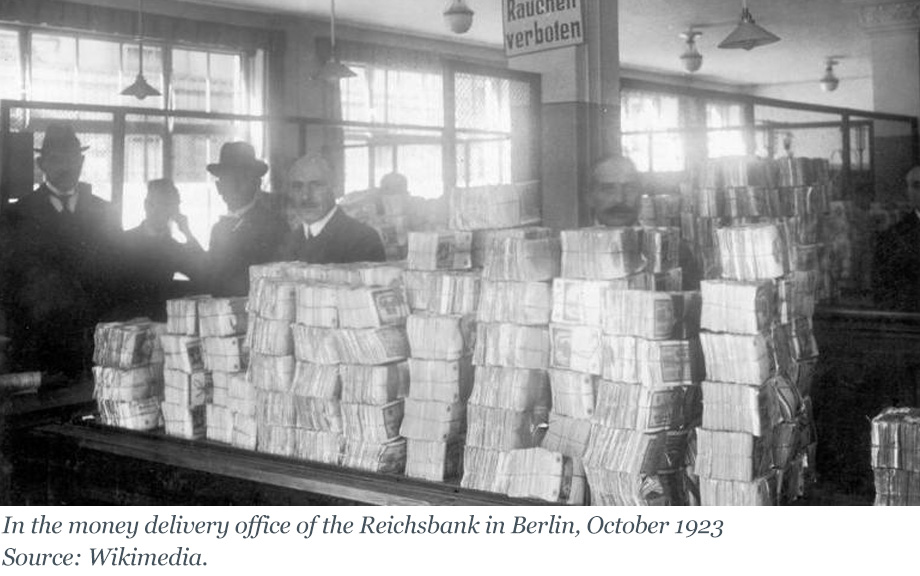

Inflating Away the Debt: The Debt‑Inflation Channel of German Hyperinflation

The recent rise in price pressures around the world has reignited interest in understanding how inflation transmits to the real economy. Economists have long recognized that unexpected surges of inflation can redistribute wealth from creditors to debtors when debt contracts are written in nominal terms (see, for example, Fisher 1933). If debtors are financially constrained, this redistribution can affect real economic activity by relaxing financing constraints. This mechanism, which we call the debt-inflation channel, is well understood theoretically (for example, Gomes, Jermann, and Schmid 2016), but there is limited empirical evidence to substantiate it. In this post, we discuss new insights from one of the key events in monetary history: the Great German Inflation of 1919-23. Because this case of inflation was both surprising and extremely high, Germany’s experience helps shed light on how high inflation impacts firms’ economic activity through the erosion of their nominal debt burdens. These insights are based on a recently released research paper.

Where Is Inflation Persistence Coming From?

Elevated inflation continues to be a top-of-mind preoccupation for households, businesses, and policymakers. Why has the post-pandemic inflation proved so persistent? In a Liberty Street Economics post early in 2022, we introduced a measure designed to dissect the buildup of the inflationary pressures that emerged in mid-2021 and to understand where the sources of its persistence are. This measure, that we labeled Multivariate Core Trend (MCT) inflation analyzes whether inflation is short-lived or persistent, and whether it is concentrated in particular economic sectors or broad-based.

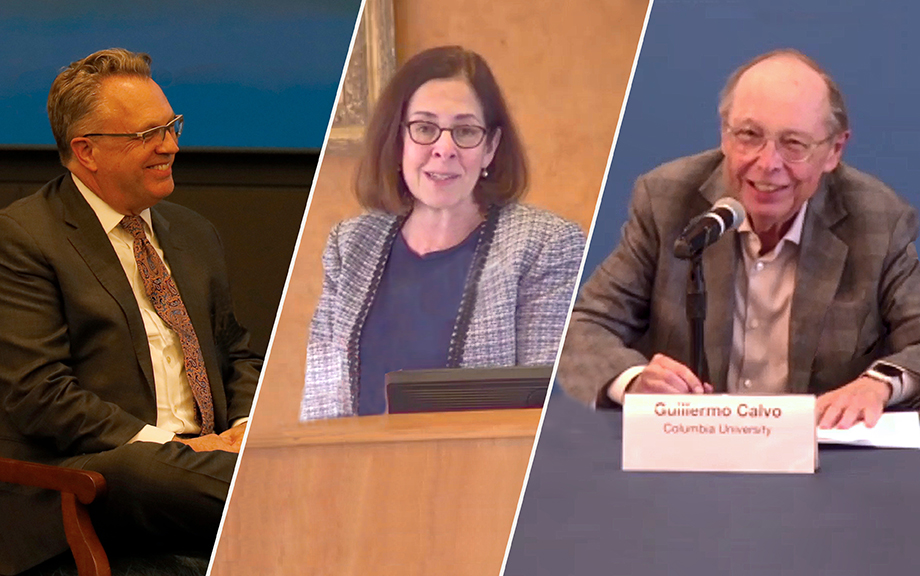

The Credibility of Government Policies: Conference in Honor of Guillermo Calvo

Guillermo Calvo is a leading member of a group of economists who revolutionized macroeconomics by modeling how incentives and the anticipation of future policies affect aggregate outcomes. In celebration of his work, a conference was held in his honor at the Federal Reserve Bank of New York and at Columbia University on February 22-24, 2023. The conference program can be found on the event website. A longer version of this post with additional detail on the proceedings can be found here.

The New York Fed DSGE Model Forecast— June 2023

This post presents an update of the economic forecasts generated by the Federal Reserve Bank of New York’s dynamic stochastic general equilibrium (DSGE) model. We describe very briefly our forecast and its change since March 2023.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics