When the Household Pie Shrinks, Who Gets Their Slice?

When households face budgetary constraints, they may encounter bills and debts that they cannot pay. Unlike corporate credit, which typically includes cross-default triggers, households can be delinquent on a specific debt without repercussions from their other lenders. Hence, households can choose which creditors are paid. Analyzing these choices helps economists and investors better understand the strategic incentives of households and the risks of certain classes of credit.

Firms’ Inflation Expectations Have Picked Up

After a period of particularly high inflation following the pandemic recession, inflationary pressures have been moderating the past few years. Indeed, the inflation rate as measured by the consumer price index has come down from a peak of 9.1 percent in the summer of 2022 to 3 percent at the beginning of 2025. The New York Fed asked regional businesses about their own cost and price increases in February, as well as their expectations for future inflation. Service firms reported that business cost and selling price increases continued to moderate through 2024, while manufacturing firms reported some pickup in cost increases but not price increases. Looking ahead, firms expect both cost and price increases to move higher in 2025. Moreover, year-ahead inflation expectations have risen from 3 percent last year at this time to 3.5 among manufacturing firms and 4 percent among service firms, though longer-term inflation expectations remain anchored at around 3 percent.

Comparing Apples to Apples: “Synthetic Real‑Time” Estimates of R‑Star

Estimates of the natural rate of interest, commonly called “r-star,” garner a great deal of attention among economists, central bankers, and financial market participants. The natural interest rate is the real (inflation-adjusted) interest rate expected to prevail when supply and demand in the economy are in balance and inflation is stable. The natural rate cannot be measured directly but must be inferred from other data. When assessing estimates of r-star, it is important to distinguish between real-time estimates and retrospective estimates. Real-time estimates answer the question: “What is the value of r-star based on the information available at the time?” Meanwhile, retrospective estimates answer the question: “What was r-star at some point in the past, based on the information available today?” Although the latter question may be of historical interest, the former question is typically more relevant in practice, whether in financial markets or central banks. Thus, given their different nature, comparing real-time and retrospective estimates is like comparing apples to oranges. In this Liberty Street Economics post, we address this issue by creating new “synthetic real-time” estimates of r-star in the U.S. for the Laubach-Williams (2003) and Holston-Laubach-Williams (2017) models, using vintage datasets. These estimates enable apples-to-apples comparisons of the behavior of real-time r-star estimates over the past quarter century.

Supply and Demand Drivers of Global Inflation Trends

Our previous post identified strong global components in the slow-moving and persistent dynamics of headline consumer price index (CPI) inflation in the U.S. and abroad. We labeled these global components as the Global Inflation Trend (GIT), the Core Goods Global Inflation Trend (CG-GIT) and the Food & Energy Global Inflation Trend (FE-GIT). In this post we offer a narrative of the drivers of these global inflation trends in terms of shocks that induce a trade-off for monetary policy, versus those that do not. We show that most of the surge in the persistent component of inflation across countries is accounted for by global supply shocks—that is, shocks that induce a trade-off for central banks between their objectives of output and inflation stabilization. Global demand shocks have become more prevalent since 2022. However, had central banks tried to fully offset the inflationary pressures due to sustained demand, this would have resulted in a much more severe global economic contraction.

Global Trends in U.S. Inflation Dynamics

A key feature of the post-pandemic inflation surge was the strong correlation among inflation rates across sectors in the United States. This phenomenon, however, was not confined to the U.S. economy, as similar inflationary pressures have emerged in other advanced economies. As generalized as the inflation surge was, so was its decline from the mid-2022 peak. This post explores the common features of inflation patterns in the U.S. and abroad using an extension of the Multivariate Core Trend (MCT) Inflation model, our underlying inflation tracker for the U.S. The Global MCT model purges transitory noise from international sectoral inflation data and quantifies the covariation of their persistent components—in the form of global inflation trends—along both country and sectoral dimensions. We find that global trends play a dominant role in determining the slow-moving and persistent dynamics of headline consumer price index (CPI) inflation in the U.S. and abroad, both over the pre-pandemic and post pandemic samples.

Breaking Down Auto Loan Performance

Debt balances continued to rise at a moderate pace in the fourth quarter of 2024, and delinquencies, particularly for auto loans and credit cards, remained elevated, according to the latest Quarterly Report on Household Debt and Credit from the New York Fed’s Center for Microeconomic Data. Auto loan balances have grown steadily since 2011, expanding by $48 billion in 2024. This increase reflects a steady inflow of newly originated auto loan balances, which in 2024 were boosted primarily by originations to very prime borrowers (those with credit scores over 760) while originations to borrowers with midprime and subprime scores held roughly steady. In this post, we take a closer look at auto loan performance and find that delinquencies have been rising across credit score bands and area income levels. We also break down auto loan performance by lender type and find that delinquencies are primarily concentrated in loans from non-captive auto finance companies.

Are First‑Time Home Buyers Facing Desperate Times?

Based on recent proposals and policy dialogue, it would appear that first-time home buyers (FTB) are indeed facing desperate times. For example, in a recent Urban Institute study, Michael Stegman, Ted Tozer, and Richard Green advocate for a zero-downpayment Federal Housing Administration (FHA) mortgage. They argue that this would be a more efficient way to deliver much needed support to help households transition to homeownership given the challenges of high house prices and mortgage rates.

Every Dollar Counts: The Top 5 Liberty Street Economics Posts of 2024

High prices and rising debt put pressure on household budgets this year, so it’s little wonder that the most-read Liberty Street Economics posts of 2024 dealt with issues of financial stress: rising delinquency rates on credit cards and auto loans, the surge in grocery prices, and the spread of “buy now, pay later” plans. Another top-five post echoed this theme in an international context: Could the U.S. dollar itself be under stress as central banks seemingly turn to other reserve currencies? Read on for details on the year’s most popular posts.

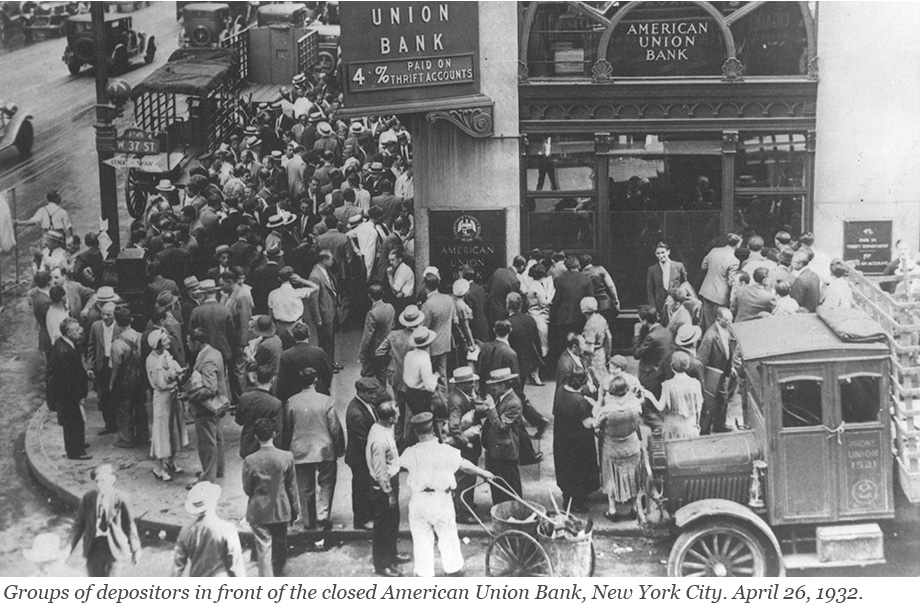

Anatomy of the Bank Runs in March 2023

Runs have plagued the banking system for centuries and returned to prominence with the bank failures in early 2023. In a traditional run—such as depicted in classic photos from the Great Depression—depositors line up in front of a bank to withdraw their cash. This is not how modern bank runs occur: today, depositors move money from a risky to a safe bank through electronic payment systems. In a recently published staff report, we use data on wholesale and retail payments to understand the bank run of March 2023. Which banks were run on? How were they different from other banks? And how did they respond to the run?

Using Stock Returns to Assess the Aggregate Effect of the U.S.‑China Trade War

During 2018-19, the U.S. levied import tariffs of 10 to 50 percent on more than $300 billion of imports from China, and in response China retaliated with high tariffs of its own on U.S. exports. Estimating the aggregate impact of the trade war on the U.S. economy is challenging because tariffs can affect the economy through many different channels. In addition to changing relative prices, tariffs can impact productivity and economic uncertainty. Moreover, these effects can take years to become apparent in the data, and it is difficult to know what the future implications of a tariff are likely to be. In a recent paper, we argue that financial market data can be very useful in this context because market participants have strong incentives to carefully analyze the implications of a tariff announcement on firm profitability through various channels. We show that researchers can use movements in asset prices on days in which tariffs are announced to obtain estimates of market expectations of the present discounted value of firm cash flows, which then can be used to assess the welfare impact of tariffs. These estimates suggest that the trade war between the U.S. and China between 2018 and 2019 had a negative effect on the U.S. economy that is substantially larger than past estimates.

RSS Feed

RSS Feed Follow Liberty Street Economics

Follow Liberty Street Economics